- B-R & H Finance - The 4 Seasons

- Posts

- B-R & H Finance ● The 4 Seasons

B-R & H Finance ● The 4 Seasons

Mid-August

Dall-E

From the rain of August 1 to the plush benches of the Fed, via giant yachts, US customs duties and the awakening of a crypto whale from the Satoshi era, this edition sails between politics, markets and economic twists. A round-up where F-35s, a strong franc, and gold at +28% cross paths.

BR & H Finance - 11.08.2025 / 11am

BR & H Finance - 11.08.2025 / 11am

Market Review

Stock markets in zero gravity, growth under anesthesia

We are entering the final third of the summer truce. Revenues are falling across Europe, yet markets stubbornly keep climbing. Two speeds, two realities.

If there’s one market that never truly knows a crisis, it’s that of yachts over 30 meters. Sure, 2008, Covid, or sanctions against Russian oligarchs caused a few ripples, but overall the tide has remained favorable. The fleet has doubled since 2008, now exceeding 6’000 units, and in 2024 the market generated Eur 7.5 billion (+1.6 billion compared to 2023). With more than 700 yachts currently under construction, one can safely bet that maintenance and marinas have bright decades ahead. Moral of the story: if you can’t beat the market, invest in the docks where it moors.

On the asset management side, two points stand out. Systematic (algorithmic) funds are overinvested, and according to UBS, they will sell if the S&P500 falls below 6’100. Traditional management, on the other hand, is underinvested. In other words, man and machine are at odds. To make matters worse, in the United States, retail investors now account for over 20% of daily trading volume, well above the historical average. So, the professional and the man on the street are also out of sync.

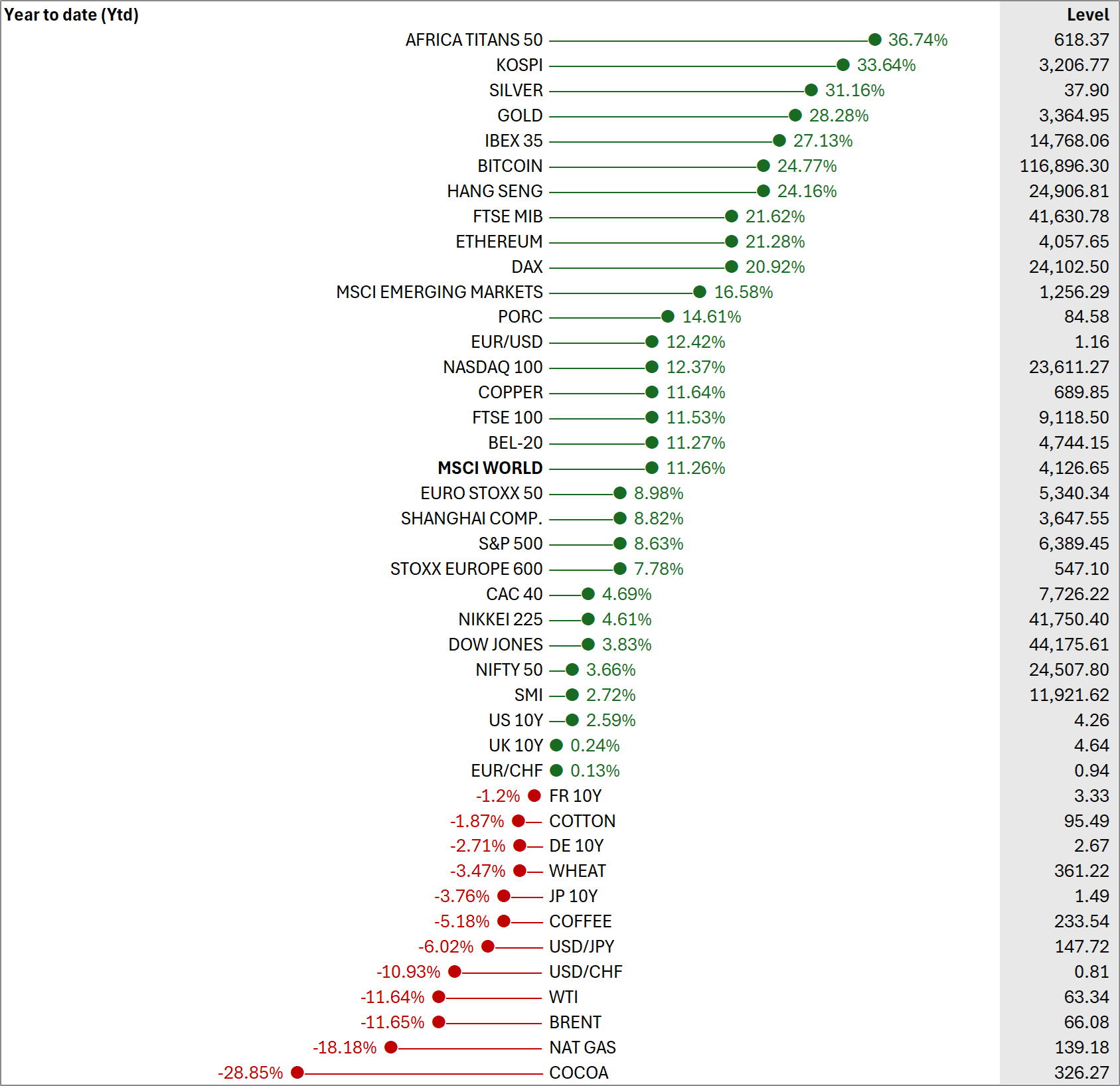

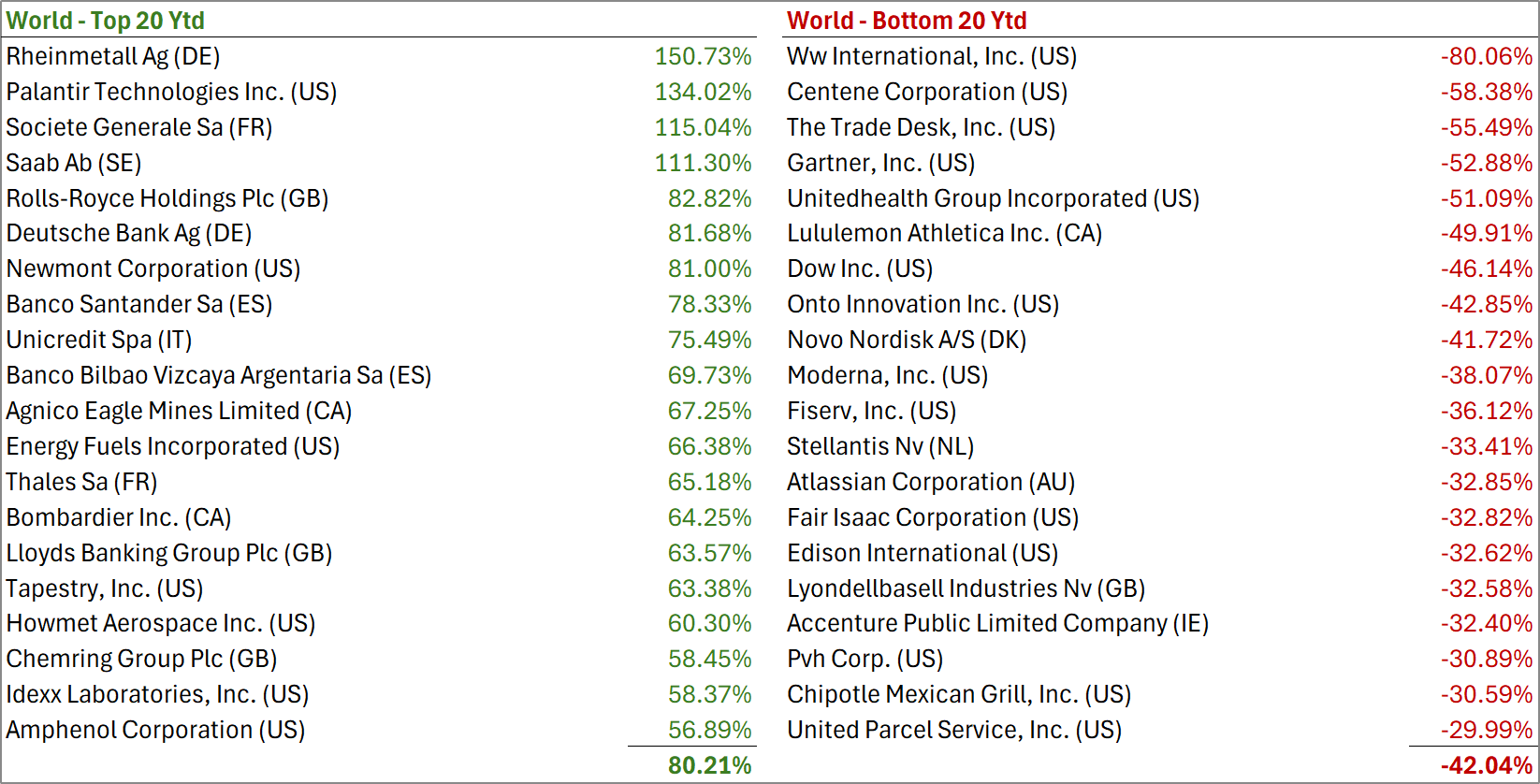

None of the markets we follow are in the red. African Titans (+37%) and the Kospi (+34%) lead the way. The SMI brings up the rear (+2.72%), too exposed to international trade and sectors without tailwinds. Nine of the ten best YTD performers are banks or defense-related stocks. A European bank at +100% in eight months without a takeover bid? We’ve never seen that before. Among the worst performers, Novo Nordisk is paying for its inability to protect its patents everywhere: such value-destructive amateurism at this level is unprecedented.

In the US, Donald Trump is extending his grip on the Fed by appointing Stephen Miran to replace Adriana Kugler. Officially, Miran has a Harvard PhD and an impeccable CV. Unofficially, he “thinks like me”, according to Trump. The Fed is still resisting presidential pressure to cut rates, but the real-estate-developer-turned-president knows the impact of expensive credit on construction. Jerome Powell, himself appointed by Trump, is holding his course against the inflationary risk caused… by Trump’s own tariffs.

Speaking of US finance, debt is changing shape. Washington has just issued Usd 100 billion in T-Bills (less than one year maturity) — a record. Issuance could reach Usd 650 to 830 billion by December. The strategy is clear: at 4.8% on 30 years, it is no longer “logical” to borrow long term.

US tariffs are now at their highest in 100 years: more than 13.5% on average across all imports. Distributors are clearing old, untaxed inventory, but new products are arriving with the surcharge baked in. And guess who will foot the bill in the end…

On the crypto front, Ethereum has made a spectacular comeback, from -40% a few months ago to +21.28% today, thanks to renewed interest in stablecoins (even though Ether is not one). Bitcoin is up 25% YTD, gold +28%, and silver is shining even brighter at +31%.

And then, on July 4, a whale from the Satoshi era awoke. Eight wallets dormant for 14 years, totaling over 80’000 bitcoins, were reactivated, moved, then partially sold. Total value: Usd 9.8 billion. Officially, an estate-planning operation. Unofficially, an episode worthy of a crypto thriller, complete with legal ultimatums inscribed in the blockchain, full-scale tests, and wild speculation — CIA, Roger Ver, Satoshi himself. The market absorbed the shock without flinching, but the episode is a reminder that in crypto, ghosts from the past can resurface at any moment.

Few numbers

Around 25% of French households have air conditioning, compared to over 90% in the United States, Japan, and South Korea.

68% of US startup funding in the first half of 2025 went to companies based in California.

People suffering from sleep disorders are four times more likely to be unhappy.

Editorial

Switzerland, neutral and disarmed

On August 1, Switzerland celebrated its National Day under torrential rain, nothing like the postcard image, especially over Basel – St. Gallen – Zurich, the country’s industrial heartland. The mood was gloomy, as if the weather was telling us we weren’t really in high spirits.

A country of consensus, a neutral nation — we negotiate here… but not with us. Micheline Widmer-Schlumpf yesterday, Karin Keller-Sutter today, both failed where Ursula von der Leyen won a half-victory. Result: Switzerland remains in the antechamber of power, condemned to dealing with second-tier players like Marco Rubio; the voice of his master.

Money is the nerve of war. In the days of banking secrecy, we kept the (often unmentionable) accounts of the PLO, dictators, and strongmen. Lombard Odier managed Usd 300 million for the PLO between 1997 and 2001, perfectly legally. We had leverage. That was a neutrality with weight — unlike Swedish neutrality which, let’s be honest, isn’t much use.

On the international chessboard, we no longer carry much weight. Condemned to buying F-35s at top price (Chf 6 billion for 36 aircraft), plus equipment, logistics, ammunition, training… for a projected total of Chf 15.5 billion over 30 years. And as if that wasn’t enough, the bill could still climb by another Chf 1.3 billion in overruns. In short, the “fixed price” became “take it or leave it”. We’ll receive them in dribs and drabs, once everyone else has been served. But what are they for? To defend a country that doesn’t need defending, bordered on all sides by Europe. We wanted to buy American to (perhaps) rebalance the trade deficit — well, that worked out. We’d have done better buying European; at least we’d share with them the fear of a common enemy.

Wedged between Iraq at 35% and Myanmar at 40%, you have to wonder what Switzerland is doing in this mess with tariffs at 39%. For SMEs, it’s a double whammy: a franc that has appreciated 11% against the USD YTD (see above).

Watchmaking is just the tip of the Swiss iceberg. We’ve made precision a totem. Our industry is a network of ultra-specialized small businesses, whose products ignore planned obsolescence: our used machines go from one developed country to another, less developed one. And with no capital gains or inheritance tax, we protect and encourage the family business.

We suffer from our image: that of a small land of plenty where people are rich, where we make watches, chocolate, and medicine. A country where life is good, where farmers are landscape gardeners. A country where the people govern with common sense (by show of hands). In the United States, no one knows the name of our capital, just as most Swiss couldn’t name their Federal Councillors. Here they are, so we can stop looking ignorant:

Karin Keller-Sutter (President of the Confederation, PLR, Finance)

Guy Parmelin (UDC, Economy, Education, Research)

Ignazio Cassis (PLR, Foreign Affairs)

Albert Rösti (UDC, Environment, Transport, Energy, Communications)

Élisabeth Baume-Schneider (PS, Interior)

Beat Jans (PS, Justice and Police)

Martin Pfister (The Centre, Defence, Civil Protection, Sports)

William Tell, the hero who supposedly shot the Habsburg bailiff, belongs to the realm of patriotic tales, founding myths, children’s stories. Nice to hear, but historically false. In reality, David doesn’t beat Goliath without a minimum of cunning — and it’s precisely that cunning we so sorely lack.

Receive market insights (and more) on the first and third Friday of each month.

If you enjoy this newsletter, please share it

Wealth

When tax lightness rhymes with tax truth

Taxing the wealthy is no longer done only when they are at home, but also when they leave. This is the new reflex of European states who, faced with the growing exodus of their wealthiest taxpayers, are tightening their exit rules. Germany, Belgium, Norway — all are revising legislation so that those leaving the ship leave a tribute on the quay. Rates can reach 45%, and the mechanisms are becoming highly technical. In Norway, for example, new rules prevent entrepreneurs from dodging the exit tax by moving abroad for a few years to collect dividends before coming back. The Norwegian tax authorities now keep close watch on such round trips.

France, true to its fiscal DNA, already applies an exit tax of 30% on unrealized capital gains above Eur 800'000, in addition to high inheritance duties and income tax. The UK recently abolished its two-century-old “non-dom” regime. Portugal, in 2023, scrapped its attractive tax regime for non-residents.

The logical consequence: Europe’s map is being redrawn. Switzerland, Monaco, Italy, and the United Arab Emirates are becoming the new magnets. In Switzerland, the lump-sum tax between Chf 100'000 and Chf 400'000 attracts Norwegians, Spaniards, and now Britons, fed up with the latest changes in inheritance taxation. In Italy, the “flat tax” regime at €200'000 a year is seducing more and more French, Americans, and Londoners seeking Milanese dolce vita and stability.

But even these fiscal havens are not immune: in Switzerland, a proposal to impose a 50% tax on inheritances above Chf 50 million will be put to a vote on November 30, 2025 (arguably the silliest referendum imaginable — a misunderstanding of why Switzerland is rich).

Disappearing: being fiscally stateless

The idea tempts some — to be fiscally resident nowhere, and taxed nowhere. But between myth and reality, the gap is vast. To be fiscally stateless, you must ensure that no jurisdiction considers you a resident.

Even if you manage to slip through the net, banks won’t play along. They require a certificate of tax residence to open an account or comply with anti-money-laundering rules. Without it: refusal, heightened scrutiny, recurring complications.

The real lever is strategy, not erasure. Settle in a low-tax, internationally recognized jurisdiction (such as the UAE or Monaco), plan your departure carefully, manage exposure under double tax treaties, avoid poor tax-timing decisions. This requires time, resources, and precise guidance.

For example, one can establish a primary tax residence in the UAE, obtaining a certificate after at least 90 days of actual presence per year, and organize the year by spending several months in France and/or Switzerland, and traveling elsewhere. For this to work, you must strictly observe each jurisdiction’s presence thresholds. In France, avoid exceeding 183 days, but also ensure you do not have your economic center or primary home there. In Switzerland, stay under 90 days without gainful activity, or 30 days if working. The fiscal anchor must clearly remain in the UAE: this means not only sufficient physical presence each year, but also strong economic, administrative, and banking ties in the country. Properly prepared and documented, this lifestyle allows you to enjoy a favorable tax framework while benefiting from international mobility.

Our opinion: You have to live your tax optimization — not try to have both the bacon and the money from selling the bacon.

Switzerland is a country where very few things begin, but many things end.

B-R & H Finance

Founded in 2004, B-R & H Finance SA is a Swiss entity specialized in wealth management. We offer a full range of personalized and independent investment services and advisory solutions. Regulated by SO-Fit and authorized by FINMA, we are also members of the ASG (Swiss Association of Independent Asset Managers) and work with leading custodian banks.

Affiliate Programs and Sponsored Content: Please note that while we strive to provide accurate and up-to-date information, we are not responsible for the content of external sites referenced in our articles, reports, or any other materials. Some links may direct you to affiliate programs or sponsored content, which will be indicated by an asterisk (*). We do not manage or endorse the privacy practices, content, or policies of these third-party sites. We encourage you to carefully read their privacy policies and terms and conditions before engaging with them.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell securities or adopt an investment strategy. The information, opinions, and analyses presented here are based on sources believed to be reliable and are expressed in good faith, but no explicit or implicit guarantee is made regarding their accuracy, completeness, or reliability. Stock market investments are subject to market and other risks, and there is no guarantee that investment objectives will be achieved. Past performance is not indicative of future results.