- B-R & H Finance - The 4 Seasons

- Posts

- B-R & H Finance ● The 4 Seasons

B-R & H Finance ● The 4 Seasons

November 2025

Nano Banana (Google Studio AI)

To our English-speaking readers, apologies—this edition centers on French taxpayers.

More seriously, in an era of A.I.-driven efficiency, it’s striking that Parliament debates only how to tax more, not how to spend better—or less.

Productivity, not new levies, is the missing chapter

B-R & H Finance - 03.11.2025 - Purely indicative

B-R & H Finance - 03.11.2025 - Purely indicative

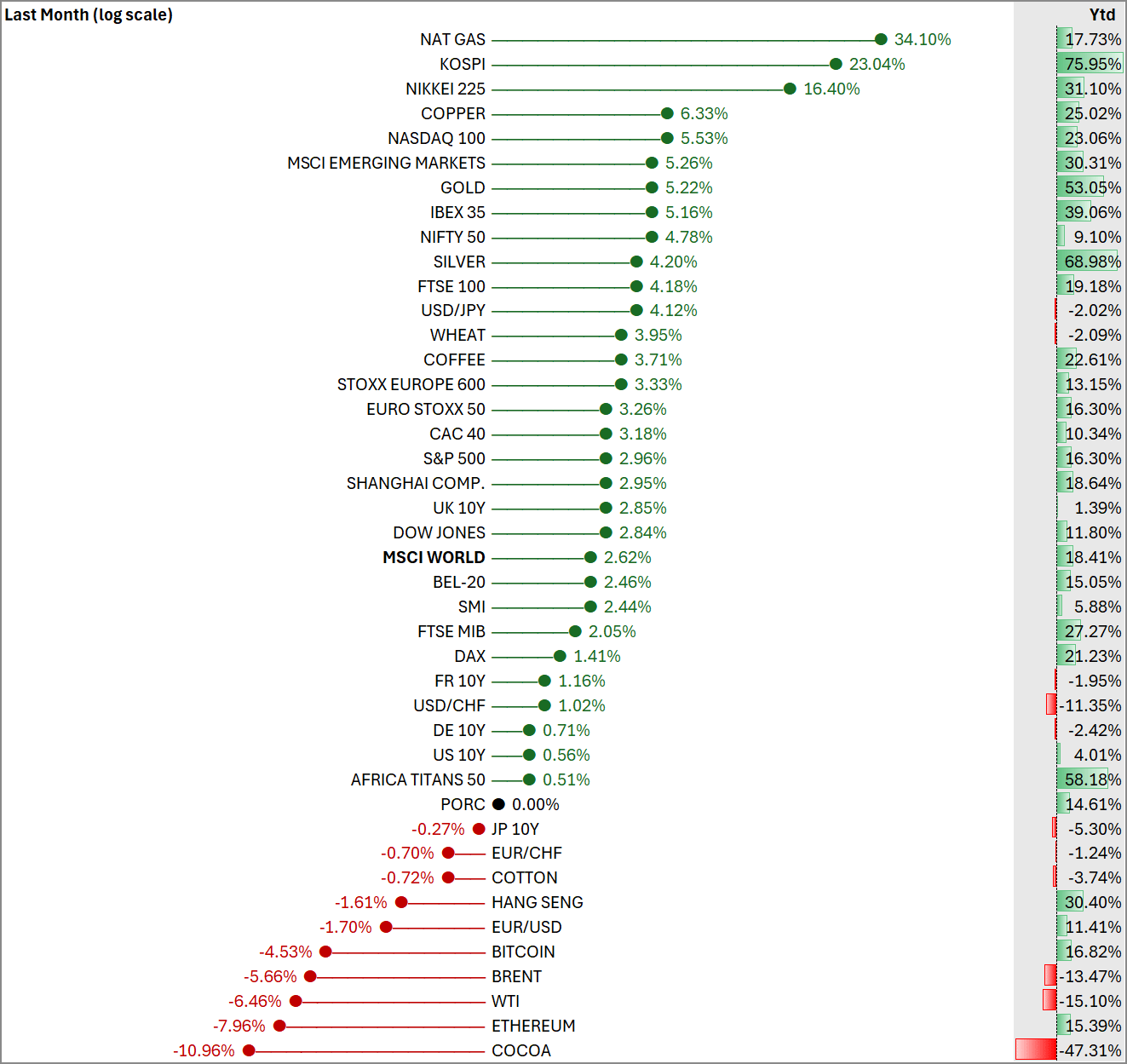

Market Review

The market only cares about AI

Breaking news: over the past 48 hours, the market has weakened, while the report below only reflects the situation as of end-October. Goldman Sachs sums it up well:

October review

The backdrop hasn’t changed: U.S.–China tensions and a tougher line toward Beijing and Moscow; uncomfortable, not disruptive for portfolios. Wall Street also shrugged off shutdown headlines.

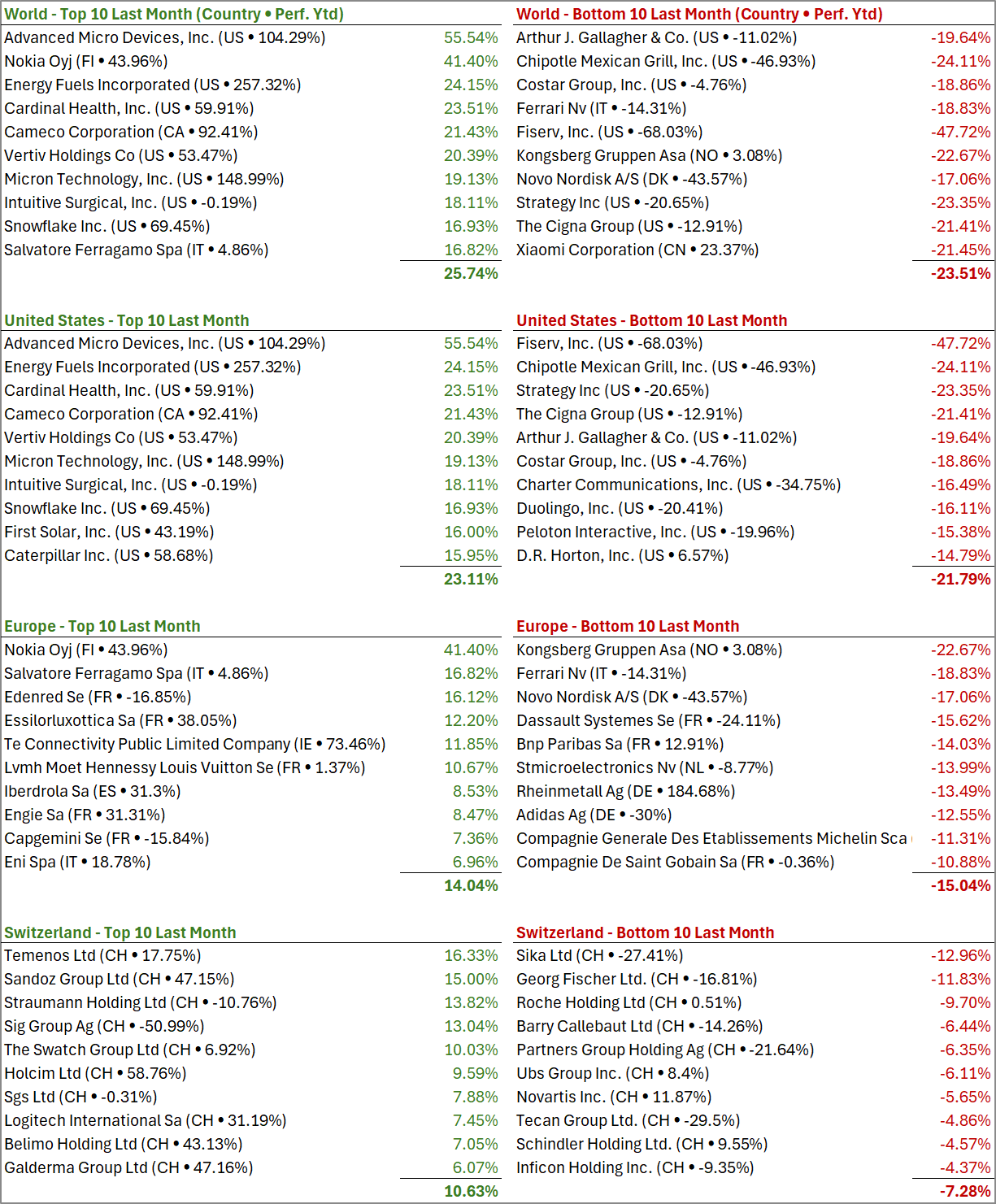

A.I. remains the common thread. The platforms’ capex cycle is the market’s compass, driven by Alphabet, Amazon, AMD and Nvidia. Mega-caps in the U.S., Japan and Korea lead. Semiconductors and HBM memory are the pivot, supporting the Nasdaq and the wider ecosystem of “AI-capex beneficiaries” (data-center equipment, power, cooling). Even Nokia is riding the A.I. wave.

Rates: the U.S. 10-year ~4.1% with a re-steepening curve as markets price Fed cuts. In the euro area, the ECB is on hold with sparse guidance. The OAT–Bund spread ~75–80 bps, off panic highs, but France’s risk premium persists.

Quick tour: Nikkei225 +16.4% Mtd, all-time high; largest monthly jump since 1994. KOSPI +23%, new record on semis/defense. Eurostoxx50 tracks the pan-Europe surge; IBEX35 finally beats its 2007 peak on banks. Copper at a record near Usd 11'200/t. Bitcoin consolidates after ETF outflows; BlackRock’s U.S. fund anchors AUM and BTC hovered near Usd 110'000 late last week; Ethereum ~Usd 3'700–3'900, below its prior ATH ~Usd 4'950.

Switzerland: SMI’s defensive tilt lagged the A.I. rocket, though recent CHF weakness helped. The Swatch Group +10% on “bottoming-out” hopes. Novartis slipped after announcing a U.S. acquisition ~Usd 12B.

Stock highlights: Nokia Oyj +41.4% Mtd, decade high (2015–2025) on optics/A.I. and ~Usd 1B (~2.9%) from Nvidia. AMD +55.5% Mtd on a high-profile supply deal and the A.I. capex cycle. Ferrari −18.8% after underwhelming long-term targets. Novo Nordisk under pressure from U.S. pricing/governance headlines. Xiaomi −21.4% Mtd on profit-taking; we remain fans (+23.3% Ytd), a blend of Apple and Tesla in our view.

Consumption & health: GLP-1 users cut food spending by ~Usd 218/month, mainly fatty “junk” like sodas; business models adjust, new niches open.

Key message: Markets remain A.I.-driven; earnings are solid; breadth is improving, even if platforms still lead. We stay exposed to A.I.-capex and select quality cyclicals, with disciplined risk. As Nvidia crossed Usd 5'000 billion in market cap, we trimmed by one-third after nearly 2'000%.

Few numbers

AI: large-scale workforce reductions

| China: Beijing–Shanghai HSR keeps getting faster

|

Editorial

|

UK takes payers aren’t alone, there’s worse…

I’m horrified by the tax component of France’s 2026 budget. As a subscriber to Les Échos, scarcely an issue goes by without 1 to 5 articles on taxation; CDHR, CEHR, the return of the exit tax, a universal tax, a levy on holdings (see the “Wealth” section), a higher flat tax, the restoration of the wealth tax, taxing capital gains on principal residences, taxing Nobel Prize winners, and so on... It’s so complicated that most lawmakers simply follow their party’s line without understanding it.

The result is absurd situations where some amendments desired by the National Assembly are rejected, while others it refused end up being accepted. Fortunately, the Senate is acting as a buffer while we wait for a dissolution that will drain the Assembly’s soft belly (Greens, MoDem, Horizons, EPR…) in favor of RN and LFI—and cost France between 0.3% and 0.5% growth in the year a new Assembly is elected.

Companies don’t vote. And the rich are a tiny electoral minority. So in a parliament without a majority, it’s tempting to go looking where there’s the least noise at the ballot box.

The budget debate has turned into a tax obsession. France already taxes a lot (too much), spends even more, and then wonders why the deficit doesn’t shrink; the real taboo is spending productivity—in other words, the efficiency of the administration in the age of AI. The numbers are stubborn: levies at 43.8% of GDP in 2023 versus an OECD average of 33.9%; a deficit path still aiming for 4.7% of GDP in 2026; public-sector headcount at 5.8 million out of 30.4 million employed overall, meaning roughly 19% of jobs in France are in the public sector. In plain terms, 1 in 5 French workers works for the state. In France, it’s fashionable to criticize Milei and Meloni, but they are at least tackling spending.

The mechanism no one wants to look at is the one Parkinson already highlighted when observing the British Admiralty: the fewer ships in the Royal Navy, the more civil servants at the Admiralty; bureaucracy grows by inertia, not by need. Technology changes the equation. Serious studies converge on this point: generative AI could automate 30% of working hours by 2030 (OECD 09.2025). If Amazon is already doing it, why not the French state? Or are we maintaining a bureaucracy as a form of disguised unemployment insurance? AI is advancing by leaps and bounds; the longer we wait, the more we spend for nothing, and the deeper the deficit gets (Q.E.D.). Raising taxes only delays the inevitable; it’s the chronicle of a death foretold.

One last paradox: the median wealth of the French, Usd 146k, remains among the highest in Europe (UBS – Wealth Report – 09.2025). But France as a state is one of the poorest in the developed world. Like an overindulged child drowning in debt.

The real problem? Too much operating expenditure, not enough productive investment. And a chronic inability to “tighten the belt”.

Receive market insights (and more) on the first and third Friday of each month.

If you enjoy this newsletter, please share it

Wealth

French holding companies and other considerations

It should be emphasized that all the taxes listed below will only come into force if the budget is passed, and that is far from guaranteed. Nonetheless, even if the budget is not adopted, it sets the tone for what the Assembly will try to push through in the future, so “you’ve been warned”.

Last Friday, the National Assembly is going after yachts, private jets, passenger vehicles outside a business activity, jewelry and artworks not open to the public (ref. 150 VI of the CGI), fine wines, residences for personal use. The control threshold is raised to 50% (individual/extended family). On that basis, the tax is set at 20% per year (yes, you read that right: 20%). This is not a wealth tax; it’s a warning to owners who park personal assets in a holding company.

In real life for large estates, a yacht or a jet is almost never booked directly in a French holding; you park them in dedicated SPVs, with a flag and registration where operations are easier, VAT minimized, insurance and leasing optimized, then you upstream the asset. If, despite these Russian dolls, the asset ends up on the books inside the perimeter of a French holding controlled 50% by an individual or family, then the 20% “luxury” base applies. What’s still unclear is the scope of “ownership”: only direct, or also look-through via subsidiaries and consolidation.

Historically, artworks were exempt from the ISF and, since 2018, outside the scope of the IFI (which only targets real estate). Here, we’re talking about a new tax on luxury goods housed in a holding. The amendment expressly refers to Article 150 VI of the CGI—the same article used as the basis for the flat tax on precious objects (jewelry, artworks, collectibles, antiques). The legislator is targeting the use of companies as a screen for personal assets, not private ownership as such.

Consequences: A French holding closes on 31.12 and holds only luxury assets: yacht Eur 3'000'000, art collection Eur 2'000'000, wine cellar Eur 500'000, apartment for personal use Eur 1'500'000.

“Luxury” base = 3'000'000 + 2'000'000 + 500'000 + 1'500'000 = Eur 7'000'000.

Tax = 20% × 7'000'000 = Eur 1'400'000 for the fiscal year. This is 20% of the value of those listed assets, not 20% of the holding’s entire wealth, nor of any income.

Usufruct / bare ownership: who gets the cash, who bears the charge

The split ownership mechanics don’t change: the usufructuary receives income; the bare owners wait for the capital. But the new measure changes the estate-planning equation if the holding owns luxury assets. In that case, the tax would hit the company itself at a rate of 20% of the value of those assets, regardless of the usufruct/bare-ownership split and regardless of the fact that the usufructuary receives the cash flows. In short: income tax continues to target the usufructuary for revenues; the new levy targets the luxury stock on the balance sheet as long as family control reaches 50%.

Usufructuary abroad

When the usufructuary becomes a non-resident (Switzerland/Italy, for example), dividends from a French company are subject to a limited withholding at source (around 12.8%–15%), then taxed in the country of residence. Nothing changes with the amendment. What does change is the balance sheet: if the holding—even French—houses a yacht, a residence for personal use, or a collection not open to the public, the 20% tax would still be due in France at the company level, regardless of where the usufructuary lives.

Exit tax

Parliament is putting a tougher exit tax back on the table, close to the version introduced under Nicolas Sarkozy and later eased under Emmanuel Macron, when the cancellation period was brought down from 15 years to 2 or 5 years depending on the case. The current proposal restores a 15-year horizon, keeps the threshold at 1.3 Mio Eur, and targets taxpayers who transfer their tax residence out of France while holding significant stakes. The principle is the same: the latent capital gain on the securities is recognized on the day of departure and treated as taxable, with a possible deferral if legal conditions are met; the tax can be cancelled if the securities are kept throughout the monitoring period or in case of a return to France. The measure targets the owner of the securities who moves; if only the usufructuary leaves while the bare owners remain in France, there is no trigger on that basis. Simple example: Ms. B., tax resident for 8 years, holds a securities portfolio valued at Eur 1'800'000 with a cost basis of Eur 1'200'000; she moves to Switzerland. A latent gain of Eur 600'000 is then recognized; the corresponding tax becomes due, unless deferred. If Ms. B. keeps her securities for 15 years without a triggering event or returns to France within that period, the tax is cancelled; conversely, a sale during the period would end the deferral and make the tax immediately payable.

IFI: same letters, new scope

On Friday evening, the National Assembly voted to transform the IFI into a tax on “unproductive wealth”. The measure broadens the base beyond real estate to target assets deemed non-productive (precious metals/objects, classic cars, yachts, aircraft, digital assets, and certain euro-denominated life-insurance funds), while setting a flat rate of 1%. The threshold remains Eur 1.3 million per household, with the ability to exempt a single asset (notably a primary residence) up to a Eur 1 million allowance; the measure still has to go through the legislative shuttle, and its exact yield is not fixed.

Enough already—the cup isn’t full yet

At the same time, MPs have sharply increased the tax on share buybacks: the base is extended to all companies with revenue above Eur 750 million and the rate is raised from 8% to 33%, for a first-year yield estimated around Eur 8–8.4 billion.

Your tax is a stopgap, a sieve; we want the Zucman tax outright, not timidly; in full, not halfway

B-R & H Finance

Founded in 2004, B-R & H Finance SA is a Swiss entity specialized in wealth management. We offer a full range of personalized and independent investment services and advisory solutions. Regulated by SO-Fit and authorized by FINMA, we are also members of the ASG (Swiss Association of Independent Asset Managers) and work with leading custodian banks.

Affiliate Programs and Sponsored Content: Please note that while we strive to provide accurate and up-to-date information, we are not responsible for the content of external sites referenced in our articles, reports, or any other materials. Some links may direct you to affiliate programs or sponsored content, which will be indicated by an asterisk (*). We do not manage or endorse the privacy practices, content, or policies of these third-party sites. We encourage you to carefully read their privacy policies and terms and conditions before engaging with them.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell securities or adopt an investment strategy. The information, opinions, and analyses presented here are based on sources believed to be reliable and are expressed in good faith, but no explicit or implicit guarantee is made regarding their accuracy, completeness, or reliability. Stock market investments are subject to market and other risks, and there is no guarantee that investment objectives will be achieved. Past performance is not indicative of future results.