- B-R & H Finance - The 4 Seasons

- Posts

- B-R & H Finance ● The 4 Seasons

B-R & H Finance ● The 4 Seasons

December 2025

ChatGPT 5.1

Switzerland has just given a masterclass in economic common sense. On the 30th of November, voters rejected a 50% inheritance tax on estates above CHF 50m by almost 4 to 1, with not a single canton behind it. If you care about Switzerland as a business and wealth hub, or about what sensible tax policy looks like in a noisy world, this one is for you : full article.

B-R & H Finance / Purely indicative levels / As of 01.12.2025 17h CET

B-R & H Finance / Purely indicative levels / As of 01.12.2025 17h CET

Market Review

The finishing line is within sight…

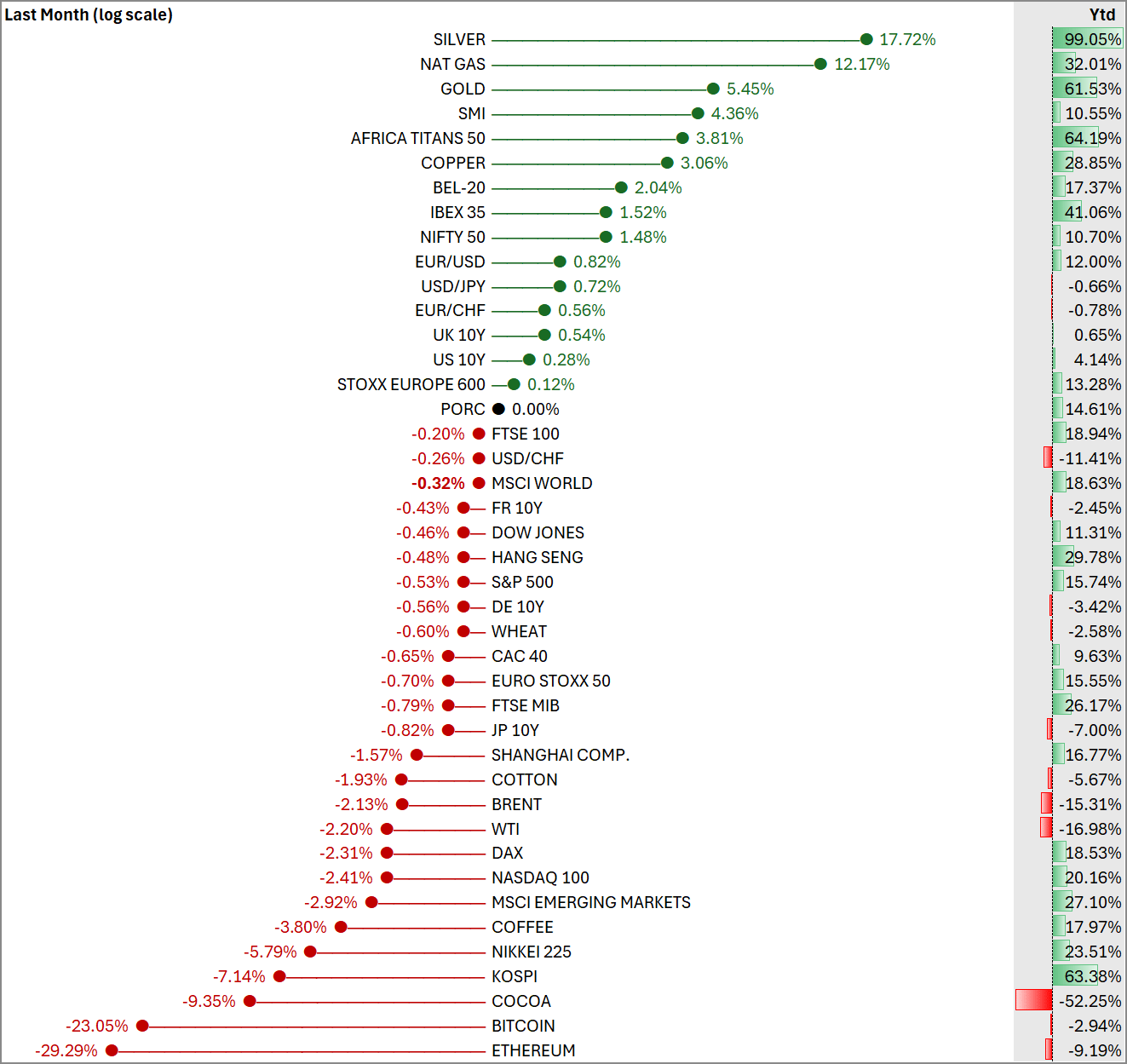

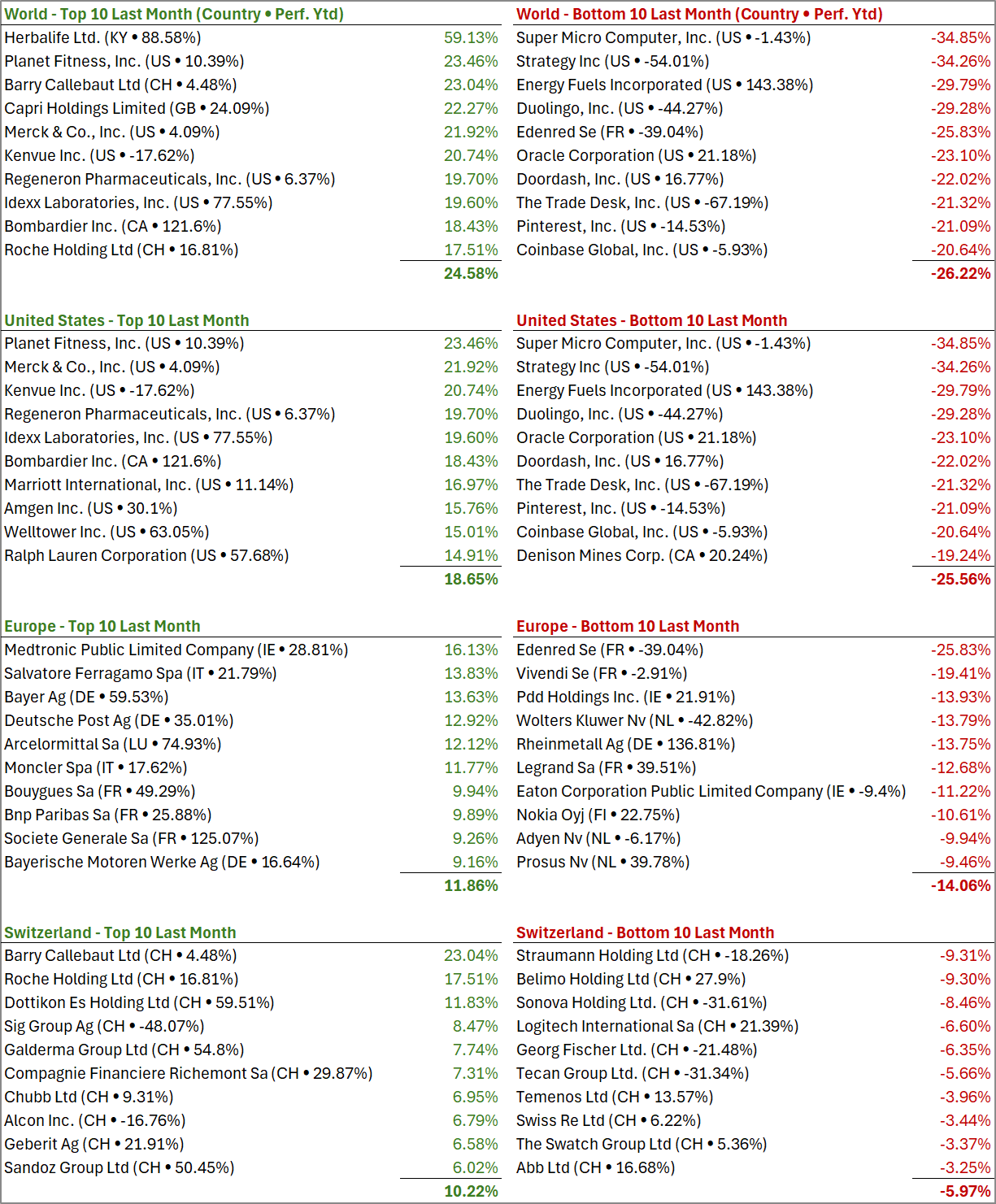

November was a month in which AI darlings wheezed, silver went parabolic and crypto reminded everyone it is still a high-beta claim on sentiment, not on cash flow. Global equities were broadly flat, with the S&P 500 slipping about 0.5% as investors fretted over an AI bubble even while Q3 earnings delivered double-digit EPS growth and tech remained the main engine of index gains.

Fed minutes from the late-October meeting kept markets guessing: Only one-third of analysts still believe in a December cut. The 10-year Treasury hovered near 4%.

In France, the merry go round was, yet a again, in full action. The National Assembly’s rejection of the 2026 budget’s revenue side and earlier ratings downgrades pushed the 10-year OAT–Bund spread into the low-70s basis-point area, keeping the CAC 40’s recovery fragile (-0.65% for the month) despite solid luxury earnings. Switzerland looked calmer: the SMI, cushioned by Nestlé, Novartis and Roche, traded not far below its March peak (+4.36% for the month and +10.55%).

Brent and WTI recorded a fourth consecutive monthly decline as oversupply trumped geopolitics, although OPEC+’s decision to hold output steady checked the slide at month-end. The real fireworks were in hard assets and digital ones. Silver broke through $55 to a fresh all-time high in late November, capping a near-100% year-to-date run as investors searched for cheaper leverage on the same macro story that has pushed gold back toward record levels on central-bank buying.

Bitcoin went the other way, slumped more than 23% (as of 1st of Dec 5pm CET, so, taking one extra day into consideration). Ethereum tracked even lower with roughly -29%, this year the Ethereum has gone through the most scary of roller coasters (-9% ytd).

Strategy Inc (MicroStrategy by any other name) traded like a turbocharged Bitcoin short, collapsing as much as 40-plus per cent after its CEO, Michael Saylor, floated the idea of selling some of the company’s massive BTC stash.

Oracle tumbled roughly a quarter in the month as investors reconsidered its debt-fuelled AI data-centre binge and bond markets began to price it as the weak link in the hyperscaler chain.

Roche benefited from raised full-year guidance and growing confidence in its pipeline, helping the stock grind higher and underpin the SMI’s defensive character.

Few numbers

Research shows that 75% of annual weight gain happens between Thanksgiving and New Year’s Eve.

In US and European households with a GLP-1 user, grocery spending falls 5–6% within six months and calorie intake drops by 15–40%.

One third of US households earn over $150,000 a year, according to economist Jeremy Horpedahl (CPS ASEC 2024).

Editorial

Sketch of a Porsche Taycan Turbo GT done by ChatGPT 5.1

Porsche Taycan Turbo GT

You know there is no turbocharger hiding in the skateboard floor. Yet the badge is there, glowing away in LED font, insisting otherwise. This is not just a car story. It is a textbook case of what happens when marketing changes the meaning of words.

The fake turbo and the ghost composer

Porsche’s story is simple. “Turbo” now means “top of the range”, a shorthand for the fastest, most expensive trim. It has stopped being a mechanical description and become a status code.

Engine sounds in EVs sit on the same continuum. Outside the car, noise is a safety requirement, especially at low speeds. Inside the car, it is theatre. Engineers carefully model synthetic “powertrain” noise that rises with speed, sometimes in partnership with Hollywood composers. On some performance EVs, the paddles even control virtual gears. The software cuts torque for a split second so your neck and ears are convinced something dramatic just happened.

None of this makes the car inherently better at the job an EV is naturally good at: clean, silent, smooth torque. These features are not trying to express the product. They are trying to protect the story.

K-beauty without Korea

“K-beauty” started as a genuine cluster: South Korean brands, specific formulations, different habits around layering skincare. There was real substance at the beginning, plus a cultural context.

Now you can buy “K-beauty inspired” products from brands that are neither Korean nor manufactured there. Sometimes the routines are simplified for Western retail, sometimes the ingredients quietly revert to whatever the supply chain already had. Again, the label began as a helpful shortcut. Overused, it becomes a vague lifestyle code.

We have seen this movie before: @, AI

There was a time when you could put an “@” in front of anything and it felt modern (spoiler: dotcom bubble). Restaurants became @Cafe, hairdressers @Style, consultancy firms @SomethingGlobal. The symbol said “we understand the internet”, even if the back office ran on faxes.

Today, the same pattern shows up with “AI”. The term has been stretched so far that it risks losing informational value. It still sells in the short term, but it does not help anyone understand what they are buying. Once you see the pattern, you see it everywhere.

When does a gimmick start to hurt?

Gimmicks are not automatically bad. A bit of theatre can make a product more enjoyable. A silly seasonal flavour might create a smile and a temporary volume bump. A Porsche owner who enjoys their fake paddle shifts has not been morally wounded. The trouble starts when three things happen at once:

The label stops discriminating : If “Turbo”, “AI”, “GTI”, “K-beauty” or “sustainable” can mean almost anything, it stops helping customers make choices. That erodes trust.

The gimmick substitutes for real progress : When energy goes into badges, sound packs and limited editions instead of better batteries, better safety, better formulas, you are chasing optics instead of improvements.

Customers discover the gap too quickly : In a world of reviews, Reddit threads and TikTok side-by-sides, flimsy claims get exposed fast. Once people feel tricked, they overcorrect and start doubting the honest parts as well.

The punchline for financial markets

Markets are full of “Turbo” badges. Smart beta, next-gen, disruptive, AI-driven, ultra-something. Funds, indices and strategies often carry labels that once described genuine innovation and now cluster around crowded trades and ordinary factor tilts. As with cars and cosmetics, the key questions are the same:

Does this label still describe a clear underlying process or edge?

Would I still buy it if the branding were stripped off and I only saw the mechanics and the fees?

Is the provider investing in substance, or mostly remixing wrappers?

Late in a cycle, you tend to see more stickers and fewer new engines. As an investor, spotting that shift early is part of risk management. In other words: by the time every product on the road calls itself Turbo or AI, the real opportunity probably lies somewhere much quieter.

Receive market insights (and more) on the first and third Friday of each month.

If you enjoy this newsletter, please share it

Investments

Novo Nordisk – A Perfect Storm

When you are priced for perfection, reality is a dangerous intruder. For Novo Nordisk , the reality of 2025 has not just intruded; it has kicked down the door (-43% ytd). The Danish pharmaceutical giant, once celebrated as Europe’s most valuable company and the invincible king of weight loss, is now weathering a perfect storm that has wiped out more than 65% of its value from the dizzying highs of mid-2024.

The question for shell-shocked investors is no longer when the stock will recover, but whether Novo Nordisk is a phoenix in the ashes, or is it the next Moderna, a one-trick pony whose trick has gone stale?

Gravity finally bites

The catalyst for the latest plunge, a 10% drop over a few trading days (drop since recovered), was the failure of semaglutide in a highly anticipated Alzheimer’s trial this November. This was meant to be the pipeline expansion that justified the valuation premium, proving that GLP-1s were a "swiss army knife" for human health. Instead, the failure exposed the company's terrifying reliance on a single molecule.

But the rot had set in months earlier. Eli Lilly has not just caught up; it has overtaken Novo, racing to a $1 trillion valuation while Novo stumbled. In the critical US market, Lilly’s Zepbound has seized momentum, aided by better supply chains and a dual-agonist mechanism that many doctors prefer. Meanwhile, "cheaper compounded versions" have flooded the market, undercutting Novo’s premium pricing power.

The Metsera Debacle

In a desperate bid to diversify, Novo attempted to outbid Pfizer for Metsera, a clinical-stage biotech with promising next-generation obesity assets. Despite offering a "superior" bid, Pfizer walked away with the prize for roughly $10 billion, leaving Novo empty-handed and, crucially, revealing a strategic straitjacket. Novo is now so dominant in obesity that regulators may effectively bar it from buying its future competitors. If it cannot innovate internally (failed Alzheimer’s trial) and cannot buy growth (Metsera), the "one-trick pony" label begins to stick.

The "Blind" Spot

The headwinds are not just financial; they are physical. The class-action lawsuits alleging that Ozempic and Wegovy cause NAION, a form of blindness, have swelled to thousands of plaintiffs. Regulators have forced a label update acknowledging the risk, which affects up to 1 in 10,000 patients.

Simultaneously, the narrative around "muscle loss" (sarcopenia) has hardened. With studies suggesting up to 40% of weight lost on GLP-1s is lean muscle, the "miracle drug" halo is slipping. For a drug meant to be taken for a lifetime, these safety overhangs are pricing nightmare.

The Asian Cliff

Looking ahead, the storm forecast worsens in 2026. That is when Novo’s core semaglutide patents expire in China. At least 11 Chinese generic makers are already at the gate, ready to flood the Asian market with cheap copycats. This "patent cliff" threatens to sever a key growth artery just as the US market becomes saturated.

Phoenix or Dog?

Analysts are beginning to whisper the dreaded comparison: Moderna. Like the mRNA pioneer, Novo rode a wave of insatiable global demand for a single class of product. When that wave crested, the valuation collapsed.

Novo is not broken, it remains a cash machine with a duopoly in one of history's biggest drug markets. But the era of unbridled optimism is dead. The stock is now priced for a company facing fierce competition, legal battles, and a patent cliff. Unless its pipeline delivers a surprise win soon, the "Phoenix" scenario looks increasingly like a fantasy. For now, this Danish giant is in the doghouse.

Wealth

The Swiss are way more intelligent than you think

On 30 November 2025, Swiss voters rejected the “Initiative for a Future”; a federal 50% inheritance and gift tax above CHF 50 million, sold as climate policy, by roughly 78–79% “No” to 21–22% “Yes”. It did not just fail the required double majority of people and cantons. It was crushed (full article).

From a distance, 30 November 2025 will be read as a comforting headline: “Switzerland rejects 50% inheritance tax on the super rich.”

From inside the country, the reading should be sharper:

The golden goose survived another attack, but it has been forced to fly through unnecessary political flak.

A noisy minority has shown that it is prepared to gamble with Switzerland’s long-term attractiveness for the sake of slogans.

The majority has, thankfully, reminded everyone that economics still matters, and that climate policy and social policy need serious, broad-based financing rather than a fantasy tax on a few hundred families.

If Switzerland wants to keep attracting those families, entrepreneurs and companies, it cannot afford many more experiments like this. The message from voters is simple: Respect the people who pay the bills, stop playing games with constitutional property rights, and leave the golden goose alone so it can keep doing what it does best: laying eggs for everyone.

The American Constitution declares “All men are born equal.” The British Socialist Party add. “All men must be kept equal.”

B-R & H Finance

Founded in 2004, B-R & H Finance SA is a Swiss entity specialized in wealth management. We offer a full range of personalized and independent investment services and advisory solutions. Regulated by SO-Fit and authorized by FINMA, we are also members of the ASG (Swiss Association of Independent Asset Managers) and work with leading custodian banks.

Affiliate Programs and Sponsored Content: Please note that while we strive to provide accurate and up-to-date information, we are not responsible for the content of external sites referenced in our articles, reports, or any other materials. Some links may direct you to affiliate programs or sponsored content, which will be indicated by an asterisk (*). We do not manage or endorse the privacy practices, content, or policies of these third-party sites. We encourage you to carefully read their privacy policies and terms and conditions before engaging with them.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell securities or adopt an investment strategy. The information, opinions, and analyses presented here are based on sources believed to be reliable and are expressed in good faith, but no explicit or implicit guarantee is made regarding their accuracy, completeness, or reliability. Stock market investments are subject to market and other risks, and there is no guarantee that investment objectives will be achieved. Past performance is not indicative of future results.