- B-R & H Finance - The 4 Seasons

- Posts

- B-R & H Finance ● The 4 Seasons

B-R & H Finance ● The 4 Seasons

ChatGPT 5.2

B-R & H Finance - 02.02.2026 11am CET - purely indicative

B-R & H Finance - 02.02.2026 11am CET - purely indicative

Market Review

It is just the beginning

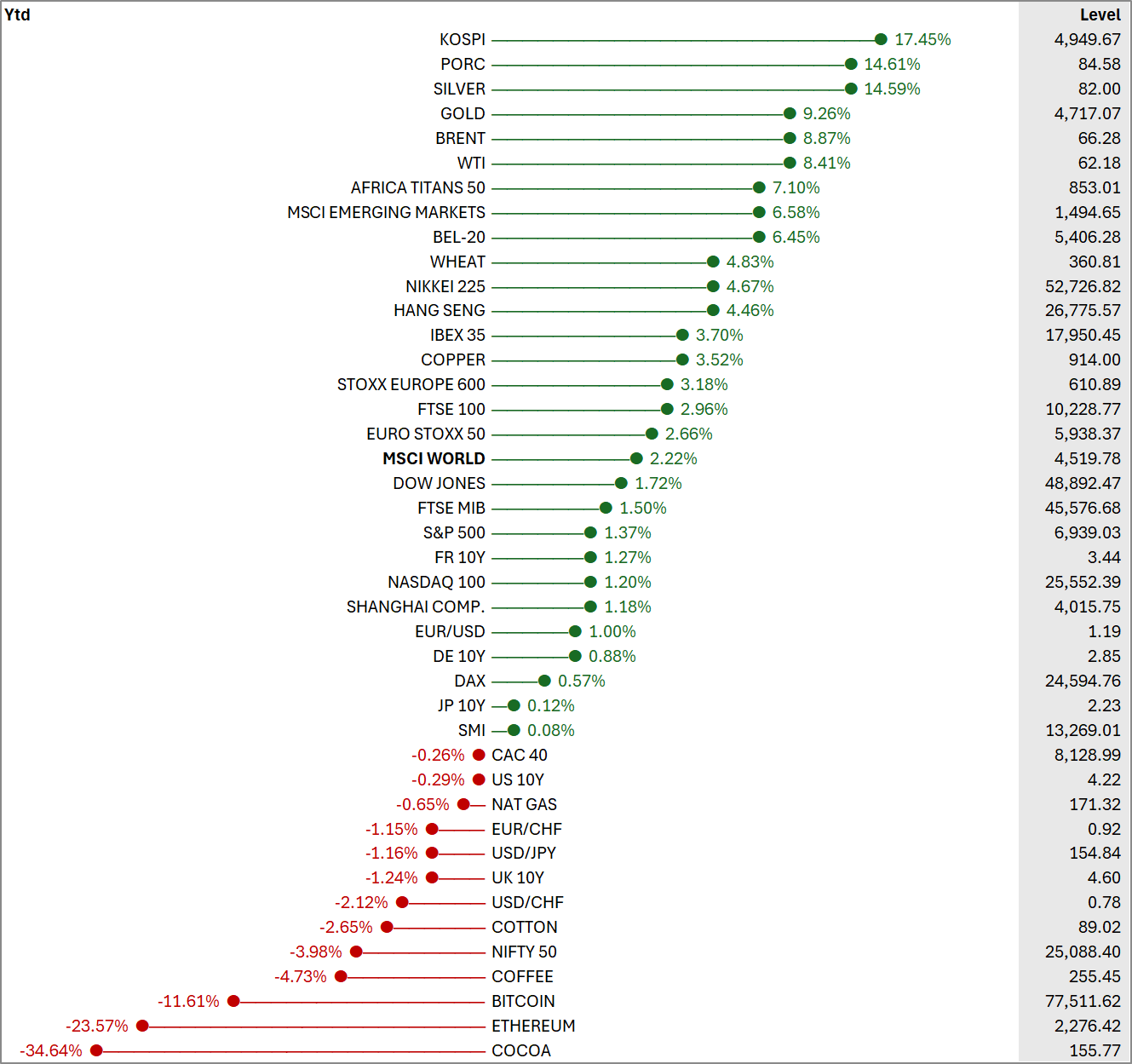

January opened on a wave of optimism before closing in volatility. Global markets had a mixed month, with the MSCI World up 2.2% but a spectacular gap between regions and sectors. South Korea surprised by breaking 5'000 points for the first time (KOSPI +17.5%), driven by a sectoral rotation from semiconductors toward automotive, defense, and nuclear, while emerging markets advanced roughly 6.6%. In the United States, the S&P500 gained a modest 1.4%, weighed down by a sharp correction in Microsoft (–10% in a single session after disappointing Azure results), while Europe showed uneven performance: Stoxx Europe 600 climbed 3.2%, but the CAC40 fell slightly.

The last day of the month upended all real assets. Donald Trump's nomination of Kevin Warsh, a historical hawk on monetary policy, as the next chair of the Federal Reserve triggered a historic flash crash: gold (–12% to 4'900 per ounce) and silver (–30% to 85 dollars) cratered as markets had largely bet on a more accommodative profile. The selloff was amplified by a cascade of CME margin calls (33% increases for gold, 36% for silver), forcing traders to liquidate futures contracts en masse.

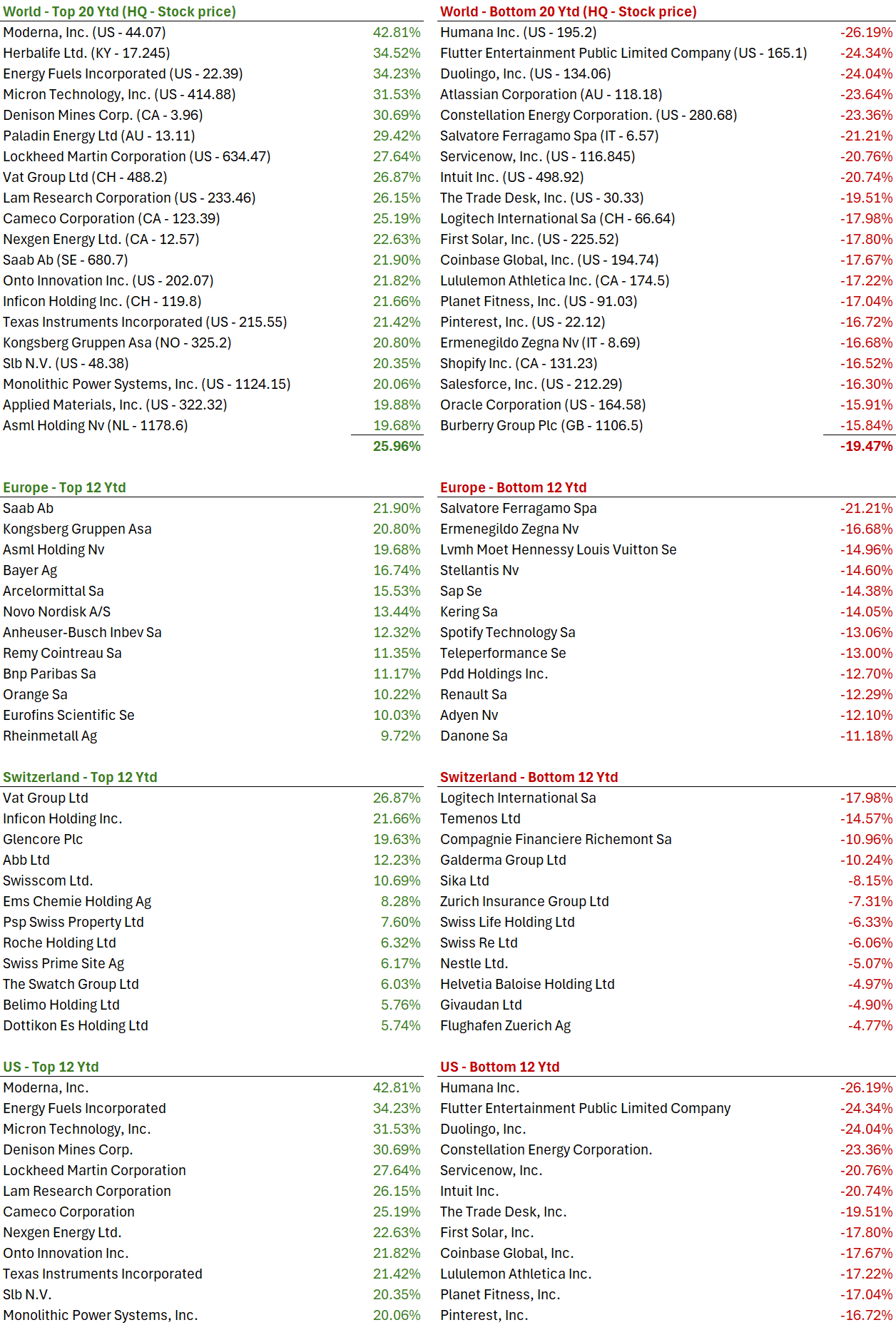

On equities, January consecrated two major themes. First, defense and nuclear energy: Lockheed Martin (+27.6%), Saab (+21.9%), and Kongsberg (+20.8%) surged after Trump announced a U.S. military budget of 1'500 billion dollars for 2027—a 50% increase—while tensions over Greenland fueled buying in European names. Second, healthcare and advanced technologies: Moderna soared 42.8% (see Investments below), while Micron Technology (+31.5%), Lam Research (+26.2%), and ASML (+19.7%) benefited from the Korean wave and expectations tied to the artificial intelligence cycle. Conversely, several pockets collapsed. Luxury disappointed: after LVMH results deemed insufficient despite a slight beat (1% organic growth, but a 3% decline in leather goods and fashion, only 1% growth in Asia), the stock fell 8% in one session, dragging Ferragamo (–21.2%), Zegna (–16.7%), and others. Bernard Arnault warned that "2026 will not be easy," citing geopolitical crises and economic uncertainty.

Microsoft erased some 400 billion dollars in market cap in a single day. On crypto assets, Bitcoin (–11.6% to around 77'500 dollars) and Ethereum (–23.6% to 2'276 dollars) suffered massive outflows from exchange-traded products (over 1.1 billion dollars in a week). As for commodities, oil advanced (WTI +8.4%, Brent +8.9%) despite analyst consensus expecting a structural surplus of over 2 million barrels per day in 2026: geopolitical noise (threats against Iran, sanctions on Russia, operations in Venezuela) supported prices, even if most experts anticipate WTI averaging around 59 dollars this year.

For the long-term investor, January 2026 tells less a change of regime than a violent redistribution of flows within a few strong convictions. The Korean sectoral rotation, the surge in defense stocks, or enthusiasm around certain biotech names remind us that markets now reward very targeted themes—semiconductors, nuclear, oncology—rather than broad-based gains. JPMorgan publicly asks "which Warsh will we get?" In this context, the dollar initially weakened (EUR/USD +1%, USD/CHF –2.1%), then rebounded sharply the day of the announcement, illustrating the nervousness of currency traders.

At the start of this year, the market's message perhaps boils down to a single image: a winter landscape already bathed in a little light, but where the path remains slippery. We move forward, but keeping one hand on the railing.

Few numbers

48.6%: Iran's annual inflation rate in October 2025—one of the world's highest for an economy of this size.

1.6 million: Approximate number of barrels of oil Iran exports daily in 2025, despite an international sanctions regime.

34.9%: Unemployment rate among young Iranian women aged 20–24 in winter 2025, over four times the country's official average unemployment rate.

Editorial

The turns we did not take

In the early eighties, our father came home carrying a Commodore 64 under his arm. It was expensive, cumbersome, and above all, in his eyes, a bet on our future. We spent hours typing lines of code on a plastic keyboard, launching small tennis games loaded from cassette. It took forever to boot, the ball flickered on screen, yet we felt we held the future in our hands.

The following year, Apple opened a showroom on Avenue Matignon. Wednesday afternoons, we disappeared among screens in black and green, soft floppy disks, mice that looked like bricks, ancestors of the MacBook, the world to come, already there, sitting on white formica tables. My brother and I never took the road to Silicon Valley. Looking back, I sometimes wonder if I regret it: we were in the right place at the right moment, yet our gaze remained that of children playing, not pioneers building.

A few years later, early in my career at the Union Bank of Switzerland. A French equity fund—Francevalor—kept delivering disappointments. Its competitor, Francit, did slightly better, but still underperformed the index. Out of curiosity, I dove into Datastream and Lotus 1-2-3, the ancestor of Excel, trying to replicate the index. It worked: we had, without knowing it, a homemade ETF. I closed the file and carried on with my life. ETFs became a market worth several trillion. Again, the turn was there, blinking orange; I watched it pass.

Engaged to Alix, we went to Kreo on rue Louise-Weiss behind Gare d'Austerlitz. I still see that "Aston Martin" chair in steel, designed by Andrew Newson, that made me dream. Walking out, we stumbled on the Perrotin gallery, where they were offering Murakami works that, at the time, weren't worth much: playful, colorful but I didn't have the eye. My brother bought photographers who later became famous, but enthusiasm for photography waned and the prices of Andreas Gursky, Thomas Struth and others never regained their peaks.

We often hear about grand missed appointments: Apple's third partner Ronald Wayne selling his stake for 800 dollars (current value: over 300 billion), the Beatles' bassist who didn't believe (Stuart Sutcliffe, sadly deceased in 1961). But mostly, our regrets are quieter. They are the turns we don't even recognize as turns: money sleeping in a checking account, an underfunded pension, a health checkup postponed, a portfolio mandate pushed off year after year "because we have time."

Being in the right place at the right moment is not enough; we must also see what that moment allows and accept drawing a concrete consequence from it. In wealth as in career, the errors that hurt most are not always spectacular stumbles, but opportunities slipping away in mild comfort. The question for each of us is not "Which turn did I miss twenty years ago?" but rather "Which fork in the road am I ignoring right now?"

Receive market insights (and more) on the first and third Friday of each month.

If you enjoy this newsletter, please share it

Investments

Are we witnessing a “Dead-Cat Bounce”?

Moderna is one of those names that condenses years of market violence into a few chapters. Before 2020, it was a promising biotech with no commercial product, living on fundraisings and hopes around messenger RNA. The pandemic changed everything: the Covid vaccine sent revenue soaring to over 19 billion dollars in 2022, before demand normalized and revenue fell to roughly 6.7 billion in 2023. When the health wave receded, the stock, which had peaked at 484 dollars on August 9, 2021, lost more than three-quarters of its value.

In 2024–2025, the purge continues: vaccine sales still decline, the company tightens its belt but piles on losses, yet it still holds a very comfortable cash position of around 6.5 billion at end-2025. At this stage, the stock trades like a biotech in disgrace (22.28 dollars in summer 2025, a 95% drawdown from peak).

In 2025, the core business remains the respiratory vaccine: in the third quarter, Moderna generates 1 billion in revenue, down 45% year-on-year, largely thanks to its next-generation Covid vaccine mNEXSPIKE. But simultaneously, management sent a more disciplined message to the market: rationalizing programs, cutting costs, a slightly more legible financial trajectory, a return-to-breakeven horizon sketched for 2028. And suddenly, the market remembered: behind the purge sits a platform, partnerships, and a real option on considerable addressable markets. For instance, there's the Phase IIb trial with Merck on melanoma that looks promising, showing nearly 50% reduction in relapse or death risk.

So are we witnessing a genuine rerating (+40% to 50% year-to-date), or only a technical bounce on an oversold name? The combination of a pipeline materializing, a more disciplined financial profile, and clearer cash visibility changes how the market views Moderna. Some analysts are beginning to reflect it: BMO Capital Markets moved from "market perform" to "buy" in January, highlighting potential leverage if seasonal vaccines and oncology deliver as expected. Others remain more cautious, speaking of "wait and see," noting the company is still unprofitable and dependent on a few large clinical trials.

For a long-term investor, the key is not confusing sympathy for a story with a portfolio holding. A company can enjoy a fine comeback in markets, but that "comeback" remains fragile. Moderna could be an acknowledged satellite, where you accept extreme volatility in exchange for an option on innovation, while keeping the core of your portfolio anchored to engines of return that are less spectacular but more predictable.

Fifteen days ago, we discussed Novo Nordisk in a similar situation to Moderna's. An interesting study was just published on this subject. Novo is an interesting case, especially after it’s worst 1d performance in history yesterday (-14.60%) on weaker than expected results.

When the time has come, the prey becomes the hunter

B-R & H Finance

Founded in 2004, B-R & H Finance SA is a Swiss entity specialized in wealth management. We offer a full range of personalized and independent investment services and advisory solutions. Regulated by SO-Fit and authorized by FINMA, we are also members of the ASG (Swiss Association of Independent Asset Managers) and work with leading custodian banks.

Affiliate Programs and Sponsored Content: Please note that while we strive to provide accurate and up-to-date information, we are not responsible for the content of external sites referenced in our articles, reports, or any other materials. Some links may direct you to affiliate programs or sponsored content, which will be indicated by an asterisk (*). We do not manage or endorse the privacy practices, content, or policies of these third-party sites. We encourage you to carefully read their privacy policies and terms and conditions before engaging with them.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell securities or adopt an investment strategy. The information, opinions, and analyses presented here are based on sources believed to be reliable and are expressed in good faith, but no explicit or implicit guarantee is made regarding their accuracy, completeness, or reliability. Stock market investments are subject to market and other risks, and there is no guarantee that investment objectives will be achieved. Past performance is not indicative of future results.