- B-R & H Finance - The 4 Seasons

- Posts

- B-R & H Finance ● The 4 Seasons

B-R & H Finance ● The 4 Seasons

Mid-December 2025

The pursuit of longevity has tempted many and satisfied few. The most reliable formulae remain disarmingly plain: eat well, mostly plants and not too much meat, sleep properly, and move a little, say 5,000 to 10,000 steps a day. Above all, cultivate social ties.

Table of Contents

B-R & H Finance / 16.12.2025 - 10.30am CET / Purely indicative

Market Review

A quick summary before turning to 2026

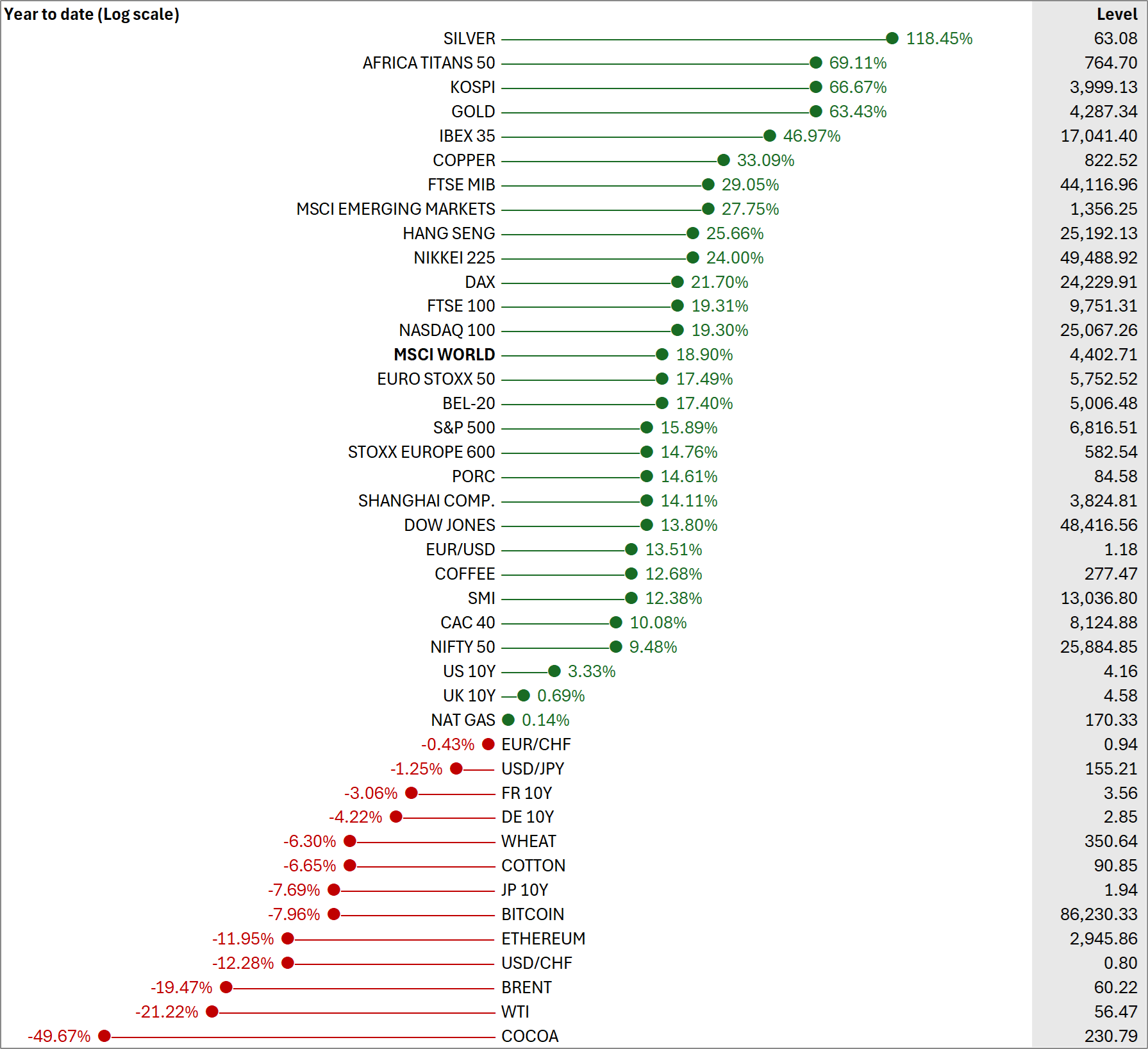

For a Swiss franc investor, 2025 looked less like a US equity rally and more like a reminder of who really keeps score. The S&P 500 rose 15.89% (level 6,816.51) and the Nasdaq 100 19.30% (level 25,067.26), but USD/CHF fell 12.28% (level 0.80). The arithmetic is unforgiving: a large slice of US equity gains was eaten by the currency.

The second lesson sits in the asset hierarchy. Returns came first from metals, then from equities, and rarely from energy. Silver topped the table with 118.45% (level 63.08), ahead of gold at 63.43% (level 4,287.34). The argument for a structural supply shortfall in silver, often asserted and seldom visible in real time, became a plausible driver. Gold, meanwhile, continued to benefit from central bank buying and steady private investment demand.

“Industrial” commodities did not begin and end with precious metals. Copper gained 33.09% (level 822.52), consistent with a market still pricing electrification and supply constraints while watching China. Coffee rose 12.68% (level 277.47). By contrast, wheat slipped 6.30% (level 350.64) and cotton 6.65% (level 90.85). A useful reminder that commodities are not a single asset class, they just share the same Bloomberg page.

Energy provided the counterpoint. Brent fell 19.47% (level 60.22) and WTI 21.22% (level 56.47). Expectations of more abundant supply and a less durable geopolitical premium eventually did the work, with year-end coloured by talk of de-escalation and potential surplus.

Another sharp reversal came in cocoa, down 49.67% (level 230.79). After a price shock, improved West African crop prospects, softer demand and the retreat of speculative positioning can turn scarcity narratives into yesterday’s story.

On equities, the table tells a year of geographic dispersion and sector concentration. The MSCI World rose 18.90% (level 4,402.71). In the US, the Nasdaq 100’s relative outperformance versus the Dow (up 13.80%, level 48,416.56) kept the same signature: an AI-heavy market driven by a small number of dominant names.

Europe mostly rewarded the periphery and the banks. IBEX 35 gained 46.97% (level 17,041.40) and FTSE MIB 29.05% (level 44,116.96), while the DAX advanced 21.70% (level 24,229.91) and the CAC 40 only 10.08% (level 8,124.88). The gap is a neat way to price politics without writing an editorial.

The tariff episode was noisy but not durably contagious. After the initial shock around April announcements, market conditions normalised quickly and volatility ebbed. Trade risk was priced, then largely faded, until the next episode.

Bonds, often declared in permanent crisis, look more nuanced in the numbers. Ten-year benchmarks show modest year-to-date moves: US 10Y +3.33% (yield 4.16), UK 10Y +0.69% (yield 4.58). The euro area is negative: DE 10Y -4.22% (yield 2.85), FR 10Y -3.06% (yield 3.56). The point is not that deficits have stopped mattering, but that policy paths and growth expectations have mattered more, especially when central banks leave the door ajar for easing.

In short, 2025 was neither cleanly “risk-on” nor “risk-off”. It was, more prosaically, a year in which the right exposure mattered as much as the right asset, and in which the Swiss franc reminded investors that it does not merely protect, it rewrites the result.

For bitcoin: see the very end of the newsletter.

Few numbers

Hermès: Birkin and Kelly bags are said to account for 25% to 30% of revenue. Each bag is made by a single artisan in roughly 20 hours, from 36 pieces of leather. Annual output is estimated at about 120,000 units.

Global debt: It is estimated to have risen by $26.4tn over the first three quarters of 2025, reaching a record $346tn (IIF), roughly 310% of world GDP.

Wealth concentration: In early 2024, the wealthiest half of households held 93% of total wealth, the other half 7%. The top 10% held 48% of assets, and the top 5% 34%.

Editorial

It’s been too long…

A number of American billionaires have set their sights on longevity, sometimes with spectacular technologies, not always with persuasive results. Meanwhile the most effective prescriptions remain stubbornly ordinary: decent food (mostly plants, not too much meat), proper sleep, a minimum of exercise, say 5,000 to 10,000 steps a day, and, above all, social connection.

As children, friendship happened because you were there. Same time, same place, same boredom, same sandbox. The social contract fit on three lines: “Want to play?”, “Same team?”, “You can borrow my spade.” The striking thing is the simplicity of the recipe: proximity, repetition, a shared pretext.

Then you grow up and forget the recipe

As adults, we swap the spade for a calendar and send awkward messages: “It’s been a while, we should catch up.” That “should” is already a defeat. It files friendship under tasks, somewhere between “buy Nespresso pods” and “update passwords”. At forty, we convince ourselves it requires a big evening out; we start confusing friendship with an event.

This is not nostalgia. It is housekeeping for reality

We underestimate friendship even though it is also a health variable. A meta-analysis pooling results from 148 studies (about 309,000 people) found that those with strong social relationships live longer. The inverse is just as clear: isolation, loneliness, or living alone is associated with higher mortality. On average, single people face roughly a 24% higher mortality risk than married people.

As children, life places you in the same spot, at the same hours, with the same people. Friendship is a by-product of the timetable. As adults, the logic reverses. Every meeting requires coordination. You need a date, a place, and a shared surplus of energy.

Social networks offer the illusion of a permanent connection. You know the other person changed jobs, ran a marathon, is in Lisbon this weekend. We mistake information for relationship. The result is feeling “up to date” without being present. It is comfortable, which is precisely why it is dangerous.

Time does not just create distance; it adds embarrassment. The longer you wait, the stranger it feels to restart. You tell yourself the other person has moved on, will judge you, won’t want it anyway, so you postpone again.

It is a very human trade: avoid a small awkwardness now, accept a larger loss later. And because nobody slams the door, you keep saying everything is fine.

Children are close by default. Adults become different: schedules, cities, incomes, partners, children, values, health, fatigue. Sometimes divergence is benign; sometimes it becomes distance. We often wait for the right moment, but the right moment never arrives. The fix is to do the opposite: create the moment, however small.

So pick up your phone. Choose one person. Reconnect. Your health may depend on it.

Receive market insights (and more) on the first and third Friday of each month.

If you enjoy this newsletter, please share it

Investments

In the Ellison family

First, the father

Larry Ellison’s story begins with a formative rupture. At nine months, after a bout of pneumonia, his mother entrusted him to an aunt and uncle in Chicago, who adopted him. As a young man he founded Oracle, a supplier of enterprise software and relational databases. In the late 1990s he insisted that “the internet changes everything” and pushed Oracle to rebuild its products so they could be deployed via the web. He effectively bet the company’s future on a single, prescient view.

In real life, the same competitive logic applies. In 2009 he bought the Indian Wells tournament, in the Californian desert near Palm Springs. He also built a reputation as a skipper, owner-skipper of Sayonara, winner in 1998 of the storied Sydney–Hobart, then backer of Oracle Team USA, victorious in the America’s Cup (2010, 2013).

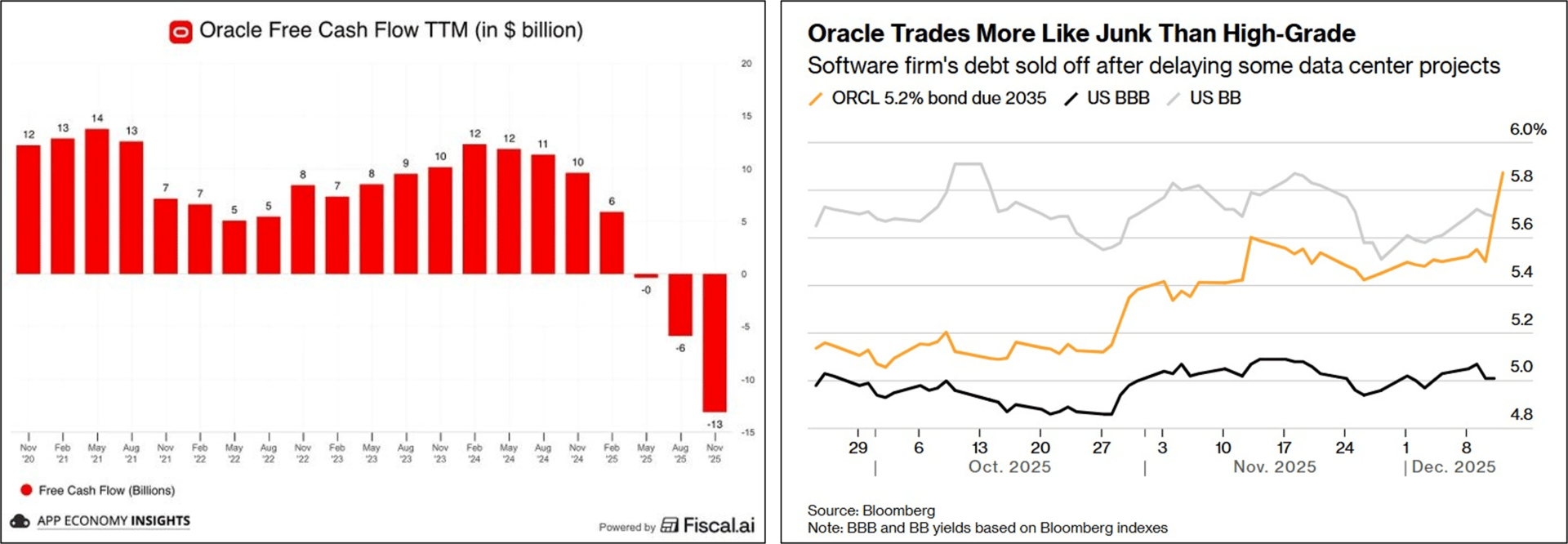

Fast-forward. Ellison has a new vision, artificial intelligence. The paradox, at the end of 2025, is that Oracle increasingly resembles a cloud infrastructure player rather than a software vendor. What unsettles investors is not the “AI” narrative, it is the bill. Oracle has lifted its annual capex target to around $50bn, from $35bn previously, to reinforce its data centres, financed largely with debt. Markets, predictably, become skittish. Reuters notes that the cost of insuring against default, via CDS, has jumped to at least five-year highs.

Now, the son

Meanwhile the Ellison family is playing a different game, in Hollywood. David Ellison, via Paramount Skydance, has triggered a spectacular escalation against the Netflix–Warner Bros Discovery (WBD) agreement. Netflix announced on 5 December 2025 a deal to buy WBD’s studios and streaming business for $72bn. Three days later, Paramount Skydance launched an all-cash hostile offer at $30 per share, valuing the transaction at around $108.4bn.

Donald Trump’s son-in-law, Jared Kushner, is cited via his Affinity Partners fund as part of the offer’s financing, which helps explain why Trump said on 8 December that he would “have a say” in the review of the Netflix–WBD deal.

For Netflix, the synergy story is easy to sell: control of a portfolio of franchises (HBO, Warner, DC, Harry Potter), faster global scaling of streaming, and the familiar “critical mass” argument versus YouTube.

The series is not finished. One thing, however, is already clear. Existing WBD shareholders appear to have drawn the winning ticket. Between the Netflix bid and the $30 topping offer, the premium is real and the market has priced it in, with the stock trading a whisker from the proposed price. For future shareholders, the equation is less forgiving. At this valuation, synergies need to show up quickly and funding must remain sustainable, otherwise the “victory” will prove expensive.

Wealth

One last for the road

At year-end, it is hard to resist a few lines on Michael Saylor, the architect of MicroStrategy’s Bitcoin pivot. The company has repeatedly tapped debt markets, notably through convertible bonds, to fund bitcoin purchases (current price $86,200, down 8% YTD). At these levels the structure is under pressure. When the price falls, the machinery starts to seize up and leverage works in reverse.

Still, Saylor has just published his “21 precepts”. Here they are:

Short letters and long friendships, that’s my motto.

B-R & H Finance

Founded in 2004, B-R & H Finance SA is a Swiss entity specialized in wealth management. We offer a full range of personalized and independent investment services and advisory solutions. Regulated by SO-Fit and authorized by FINMA, we are also members of the ASG (Swiss Association of Independent Asset Managers) and work with leading custodian banks.

Affiliate Programs and Sponsored Content: Please note that while we strive to provide accurate and up-to-date information, we are not responsible for the content of external sites referenced in our articles, reports, or any other materials. Some links may direct you to affiliate programs or sponsored content, which will be indicated by an asterisk (*). We do not manage or endorse the privacy practices, content, or policies of these third-party sites. We encourage you to carefully read their privacy policies and terms and conditions before engaging with them.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell securities or adopt an investment strategy. The information, opinions, and analyses presented here are based on sources believed to be reliable and are expressed in good faith, but no explicit or implicit guarantee is made regarding their accuracy, completeness, or reliability. Stock market investments are subject to market and other risks, and there is no guarantee that investment objectives will be achieved. Past performance is not indicative of future results.