- B-R & H Finance - The 4 Seasons

- Posts

- B-R & H Finance ● The 4 Seasons

B-R & H Finance ● The 4 Seasons

Apologies to our regular readers: it appears the first edition of “The 4 Seasons” was not distributed in its English version. Given the events in Crans-Montana, this issue contained no articles, only Pastor Gilles Cavin’s prayer and a set of tables summarising market performance in 2025. (link)

B-R & H Finance - Indicative as of 21st January 2026

B-R & H Finance - Indicative as of 21st January 2026

Market Review

Geopolitics joins the conversation

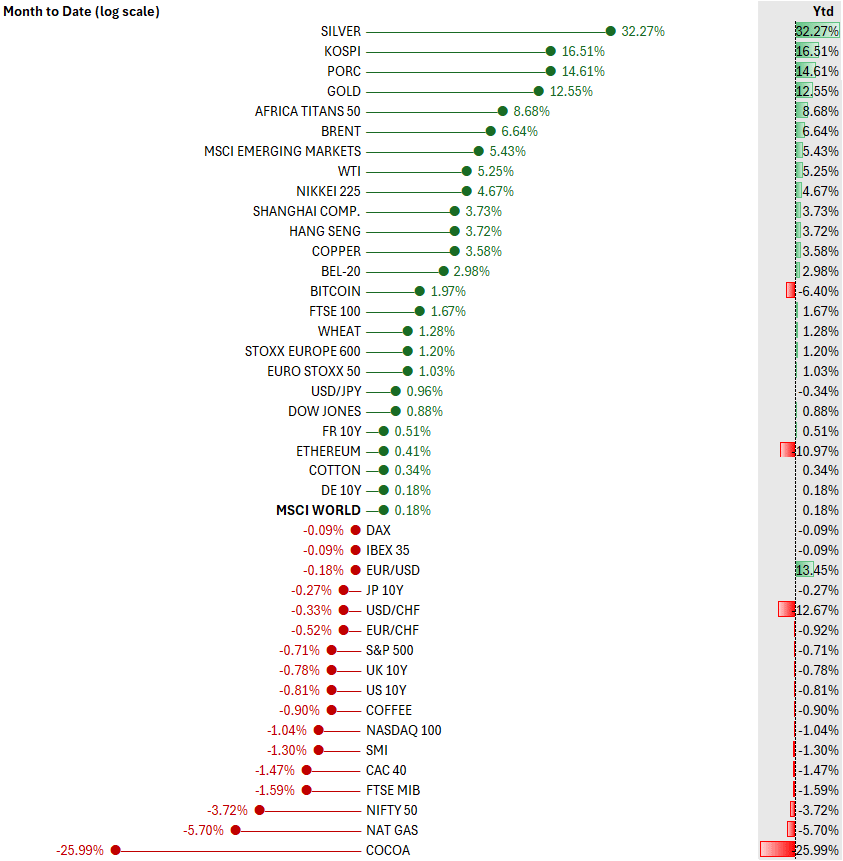

Global markets remain solid, but they are increasingly sensitive to geopolitics. South Korean and Japanese equities are trading near record highs, while gold (+12.5% ytd) and of course silver (+32.2%) are also printing fresh peaks.

United States: expensive, therefore vulnerable

US equities are pricey. The S&P 500 recently touched a record around 6,950 to 6,980 (currently 6,796), for a market cap of roughly $62 trillion and a valuation close to 22 times forward earnings, a level comparable to the 2021 peak. The index gained about 25% in 2024, then 18% in 2025. Some large banks still look for around 12% total return in 2026 if earnings grow by roughly 15%, but any shock to results or policy would hit a market that is already richly valued. The Fed cut rates three times last year, and markets are pricing in roughly two additional 25bp cuts in 2026. That supports risk assets, but it also sharpens focus on tensions between President Trump and the central bank.

Japan and Asia: rotation into equities and semiconductors

Japan is one of the main beneficiaries of the global rotation. The Nikkei 225 has reached new highs above 53,500 to 54,000, helped by a weaker yen, expectations of snap elections under Prime Minister Takaichi, reforms pushing companies to reward shareholders more generously, and renewed interest in a market that long sat out of favour. Across Asia more broadly, markets such as South Korea and Taiwan remain closely tied to the semiconductor cycle, with renewed interest in chipmakers and equipment suppliers as investors seek exposure to AI and data infrastructure.

Europe and Switzerland: calm on the surface, tension underneath

In Europe, indices can stay close to their highs even as political risk rises. The Greenland episode is a reminder that competition for resources and strategic assets is no longer theoretical, and that it can become a market issue quickly. Switzerland, for its part, retains its defensive role: large, high-quality groups and a strong franc reassure global portfolios. It is excellent insurance, but insurance comes at a price. A strong franc protects, and at the same time often caps the upside for exporters.

Gold, the franc, and oil: refuge on one side, relative easing on the other

Gold and silver are rising sharply, a sign of persistent demand for safe havens despite strong equities. It is one of today’s paradoxes: optimism on growth, but nerves on politics. By contrast, oil has cooled a little after a recent spike, on the view that the risk of military escalation, in Iran, has eased slightly.

Few numbers

19% of readers, those who read at least 10 books in 2025, account for 82% of books read, while 40% of Americans read no books at all.

Bible sales reached 19 million copies in 2025, a 21-year high, up 12% year on year and roughly double 2019 levels.

In France, the share of respondents who trust that taxes are used well fell from 33% in 2023 to 22% in 2025, down 11 points in two years.

Editorial

Trees do not grow to the sky

In fairy tales, they do.

Jack plants a bean, the stalk never stops growing, it pierces the clouds, lays out a walkway, and the child climbs. We follow because it rises, because it gleams, because we tell ourselves that up there gravity no longer has a hold.

In the real world, a tree fights for its place in the sun. In a dense forest, light is scarce; to survive, you have to climb, break through the canopy, find the gap. That is not ambition, it is photosynthesis.

The tallest known tree, a coast redwood named Hyperion, reaches 116.07 metres in Northern California, far from Silicon Valley campuses, yet in the same state where people like to believe everything can grow without limit. The most massive does not chase height. General Sherman, a giant sequoia, rules by volume, roughly 1,487 m³ of trunk. Not the most slender, the fullest. And the oldest, Methuselah, a bristlecone pine, nearly 5,000 years old. It survives through slowness, density, restraint.

Three records, three lessons. Height seduces. Mass protects. Time selects. Growth is not “moral”, it is “biological”. It obeys constraints. Markets do too. They can celebrate the ascent, then remember the cost of capital, the cycle, the balance sheet, liquidity.

The higher you climb, the more wind you catch. In finance, the higher the valuation, the longer the duration, the greater the sensitivity to regime shifts, rates, inflation, regulation, demand. The risk is not only the fall; it is exposure over time.

There is growth you can see, height. And growth you build, solidity. A mature tree does not always add metres; it thickens, reinforces, densifies. A company can slow headline growth and become a cash machine. That is not surrender, it is metamorphosis.

And then there is a tree that seems to come from before our libraries, the despair of climbers, Araucaria araucana, the “monkey puzzle”. Its story goes back to the age of dinosaurs, around 200 million years if fossils are to be believed. It armours itself with triangular leaves, stiff and sharp, designed as protection against the grazers of another era. As it ages, it sheds its lower branches, leaving a clean trunk, hard to grip, as if it were trimming the weak part to keep strength aloft.

So yes, Jack is right to climb; by the end of the tale he will carry off his loot. Markets, too, love to climb. Our job is not to forbid the ascent; it is to avoid the vertigo.

You do not tug on a tree to make it grow. You prepare the soil, you prune, you protect.

Our view, for several years now, is that a score of trees are hiding the forest: twenty stocks out of the S&P 500’s five hundred capture most of the light. This year again they will make the headlines, but a little less so.

The climate is changing. The cost of capital is becoming a constraint again, and the canopy is opening. Other trees will come back into view; some for their thickness, others for their ability to hold when the wind rises, when water is scarce, when the season shortens (value vs growth).

Receive market insights (and more) on the first and third Friday of each month.

If you enjoy this newsletter, please share it

Investments

Eleven plausible bets for 2026

Every start of year brings its share of macro and sector forecasts. Rather than add another layer, we selected the ten most recurring themes across research houses (UBS, JPMorgan, Morgan Stanley, BlackRock, among others) and offered our read.

Will Europe finally move from promises to results?

UBS expects a rebound in eurozone earnings, driven by public spending and a stronger investment cycle. After a 2025 dominated by multiple re-rating, 2026 would mark, in their view, the return of profit growth.

Our read: Europe remains the champion of big announcements with little follow-through. Industrial ambitions exist, but the means and coherence are sorely lacking. Nothing suggests 2026 will change the picture.Defence: demand remains, euphoria fades

For Goldman Sachs and BofA, the momentum stays strong, stock replenishment and multi-year budgets. But markets have already priced in part of the good news; now they will demand deliveries, margins, and stock prices that makes sense.

Our read: Europe still underestimates its strategic and technological dependence on the United States. “Buy European” looks more like a pious wish than a rational allocation at this stage.Robots: automation becomes the engine of margins

Scott Galloway sums up the move well: AI’s impact will first be measured in logistics, maintenance, and automation. Amazon illustrates this pivot toward execution AI rather than communication AI.

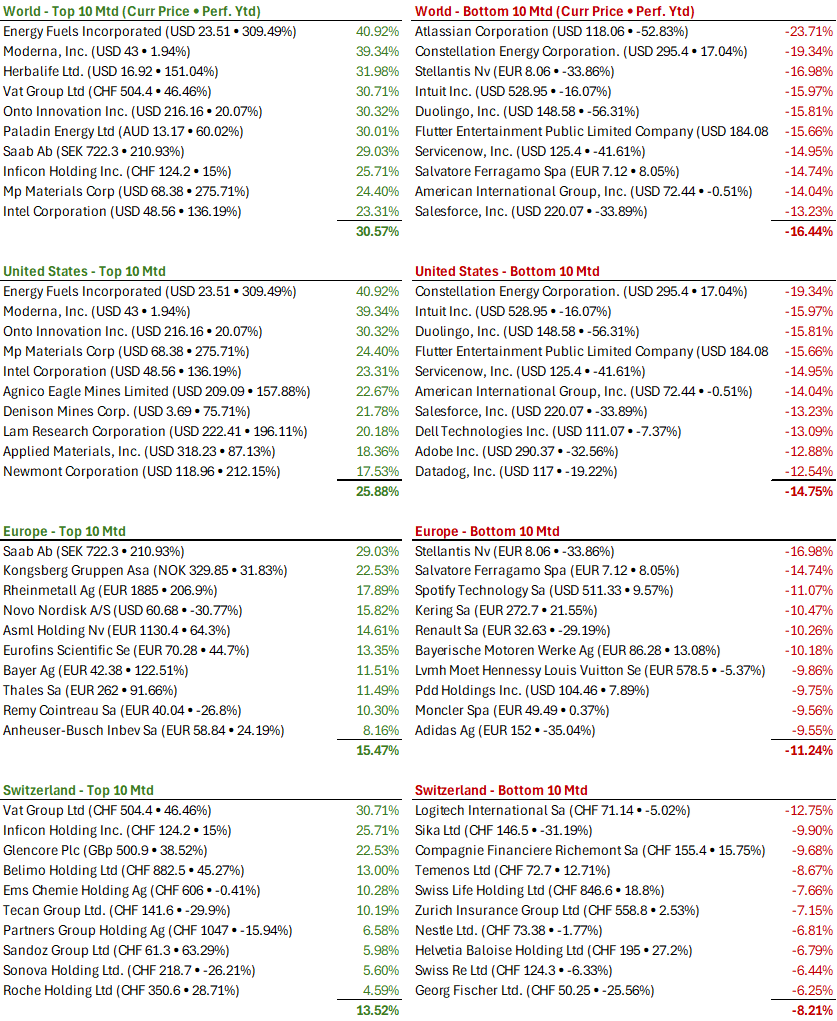

Our read: We fully buy into this view. Amazon, which underperformed the “Magnificent Seven” in 2025, could become one of 2026’s big winners again thanks to industrial AI.AI enters the enterprise, profits follow later

Morgan Stanley expects faster AI diffusion, but uneven gains across sectors. Adoption will precede profitability. The next few quarters will be choppy.

Our read: AI is progressing far faster than we perceive, so the impact for companies that adopt it will also arrive much faster, with meaningful productivity gains.Electricity, the investor’s new El Dorado

JPMorgan points to an “electricity investment gap”: between data centers, electrification, and industrial reshoring, demand is surging. ABB, Schneider Electric, Siemens Energy, Prysmian, and Vertiv are among the beneficiaries.

Our read: A captivating topic, and a complex one. Unlike 19th-century rail, data centers must constantly adapt to technological innovation. The bet is structural, but visibility remains limited.GLP-1 moves from injection to pill

Reuters reports that Novo Nordisk expects a sharp rise in oral dosing, at price points that broaden the market materially. Eli Lilly and Roche are also advancing their programs.

Our read: A quiet revolution. By reducing frequency and friction, Novo expands the patient base. Roche, lying in wait, could start to monetise from 2027.China: cheap, or risky?

UBS sees Chinese tech as a major opportunity, supported by earnings growth and depressed valuations.

Our read: Hard to deny China’s dominance, vertically and horizontally, in critical materials and innovation technologies. This is no longer a trade rivalry, it is a full-blown global conflict between China and the rest of the world. We need China to contain industrial inflation. We do think Chinese equities offer genuine opportunities.Precious metals: silver has temperament; gold has poise

UBS remains bullish on both, with an ambitious medium-term target of $5,000/oz for gold. Silver, more industrial, remains more volatile.

Our read: It is hard to love gold when you think in Swiss francs. Swiss equities, by contrast, offer dividends and more tangible growth prospects.Bitcoin settles into the institutional landscape

BlackRock notes that access channels have normalised (ETFs, dedicated funds, etc.). Bitcoin is no longer a marginal asset.

Our read: BTC has earned legitimacy as a diversifier, but remains vulnerable to manipulation and liquidity cycles. Discipline must come first.The global economy between a “managed slowdown” and “accelerated reinvention thanks to AI”

The macro consensus is surprisingly steady: no visible recession, but a two-speed world between the US (strong) and Europe (lagging). Pockets of opportunity remain regional more than sectorial.

Our read: 2026 will be about discernment. Investors will need to identify the companies that turn disruption into durable competitive advantage. Value may return over Growth.Will the dollar keep losing ground?

BNP Paribas expects the dollar to remain on a downtrend in 2026, with EUR/USD moving back up towards 1.20, supported by slightly better European growth and a monetary-policy differential that is less favourable to the United States.

Our read: we stay pragmatic. A weaker dollar is a credible scenario if the US cycle cools, but the USD quickly regains its safe-haven status whenever the world tightens up. For a Swiss-franc investor, the point is not to “bet” on EUR/USD, it is to manage USD exposure.

A small axe can cut down a big tree.

B-R & H Finance

Founded in 2004, B-R & H Finance SA is a Swiss entity specialized in wealth management. We offer a full range of personalized and independent investment services and advisory solutions. Regulated by SO-Fit and authorized by FINMA, we are also members of the ASG (Swiss Association of Independent Asset Managers) and work with leading custodian banks.

Affiliate Programs and Sponsored Content: Please note that while we strive to provide accurate and up-to-date information, we are not responsible for the content of external sites referenced in our articles, reports, or any other materials. Some links may direct you to affiliate programs or sponsored content, which will be indicated by an asterisk (*). We do not manage or endorse the privacy practices, content, or policies of these third-party sites. We encourage you to carefully read their privacy policies and terms and conditions before engaging with them.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell securities or adopt an investment strategy. The information, opinions, and analyses presented here are based on sources believed to be reliable and are expressed in good faith, but no explicit or implicit guarantee is made regarding their accuracy, completeness, or reliability. Stock market investments are subject to market and other risks, and there is no guarantee that investment objectives will be achieved. Past performance is not indicative of future results.