- B-R & H Finance - The 4 Seasons

- Posts

- B-R & H Finance ● The 4 Seasons

B-R & H Finance ● The 4 Seasons

Mid-November 2025

Replacing jobs with AI requires adapting it to each task. You don’t become a consultant, an accountant, or an M&A specialist overnight; the models will need training, and recent graduates are best placed to do that.

B-R & H Finance / 19.11.2025 - 14pm CET / Purely indicative

B-R & H Finance / 19.11.2025 - 14pm CET / Purely indicative

Market Review

Cry wolf long enough…

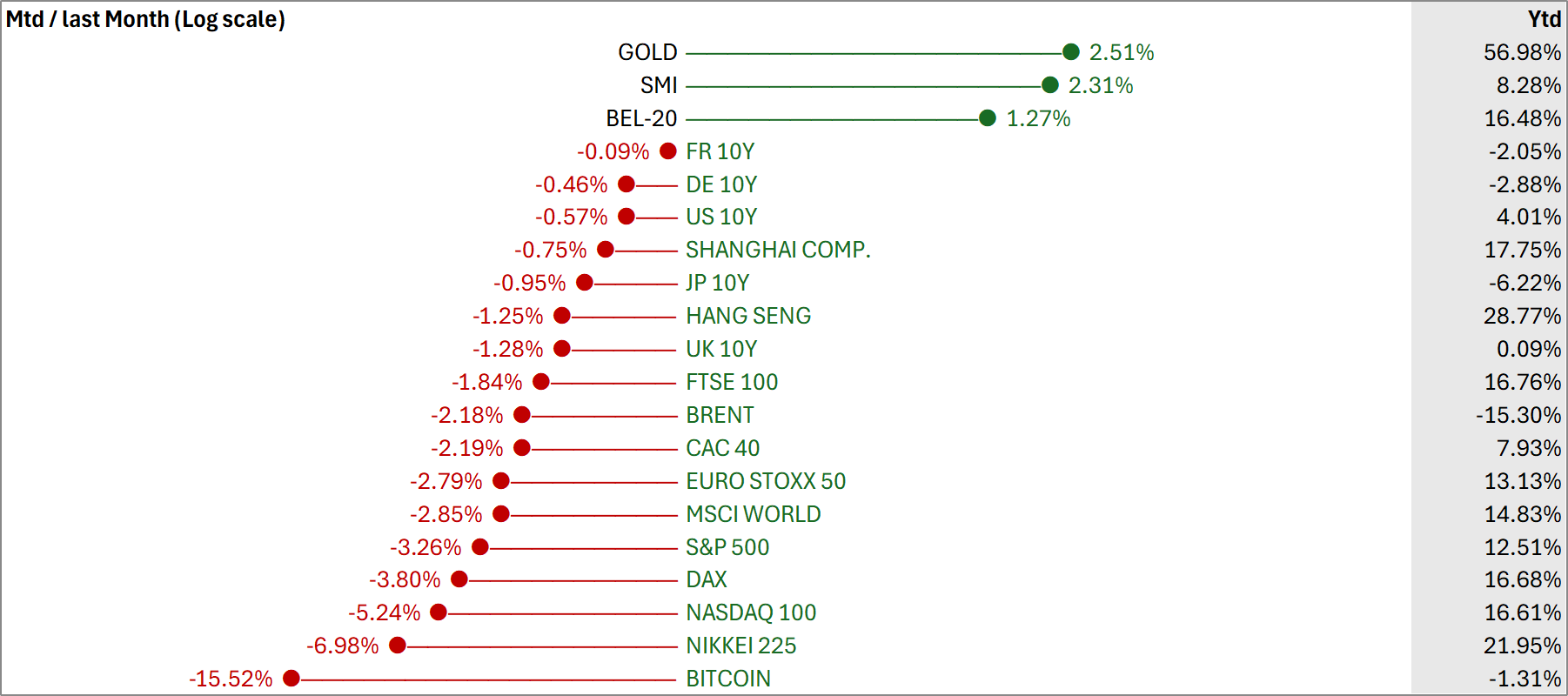

From 3 to 17 November, three overlapping themes set the tone:

The end of the historic U.S. government shutdown, which paradoxically increased uncertainty by withholding October’s key releases (jobs, inflation, spending); economists are working with limited visibility.

A sharp reset in Federal Reserve expectations: a restrictive message replaced earlier confidence in a quick easing. The probability of a December rate cut slid from almost “fully priced” in October to roughly 40–45% today.

Broad-based profit-taking across risk assets—especially cryptocurrencies, high-beta tech, and AI-linked names—after October’s outsized rally.

U.S. equities absorbed the shift with limited damage at the index level, but with a clear weakening underneath. The S&P500 traded in a 6'620–6'850 range in recent days and sits around 6'620–6'650, down on the month; the Dow is holding around 46'000–47'000; the Nasdaq remains the most shaken (-5.25% MTD).

In Asia, performance is mixed: the Nikkei slipped back below 49'000 (after a peak above 50'000 and a 22% YTD performance); India is holding up better.

In Europe, the tone remains fragile, with the CAC40/DAX pulling back amid political and budgetary cacophony.

CNN

It finally poked its nose out

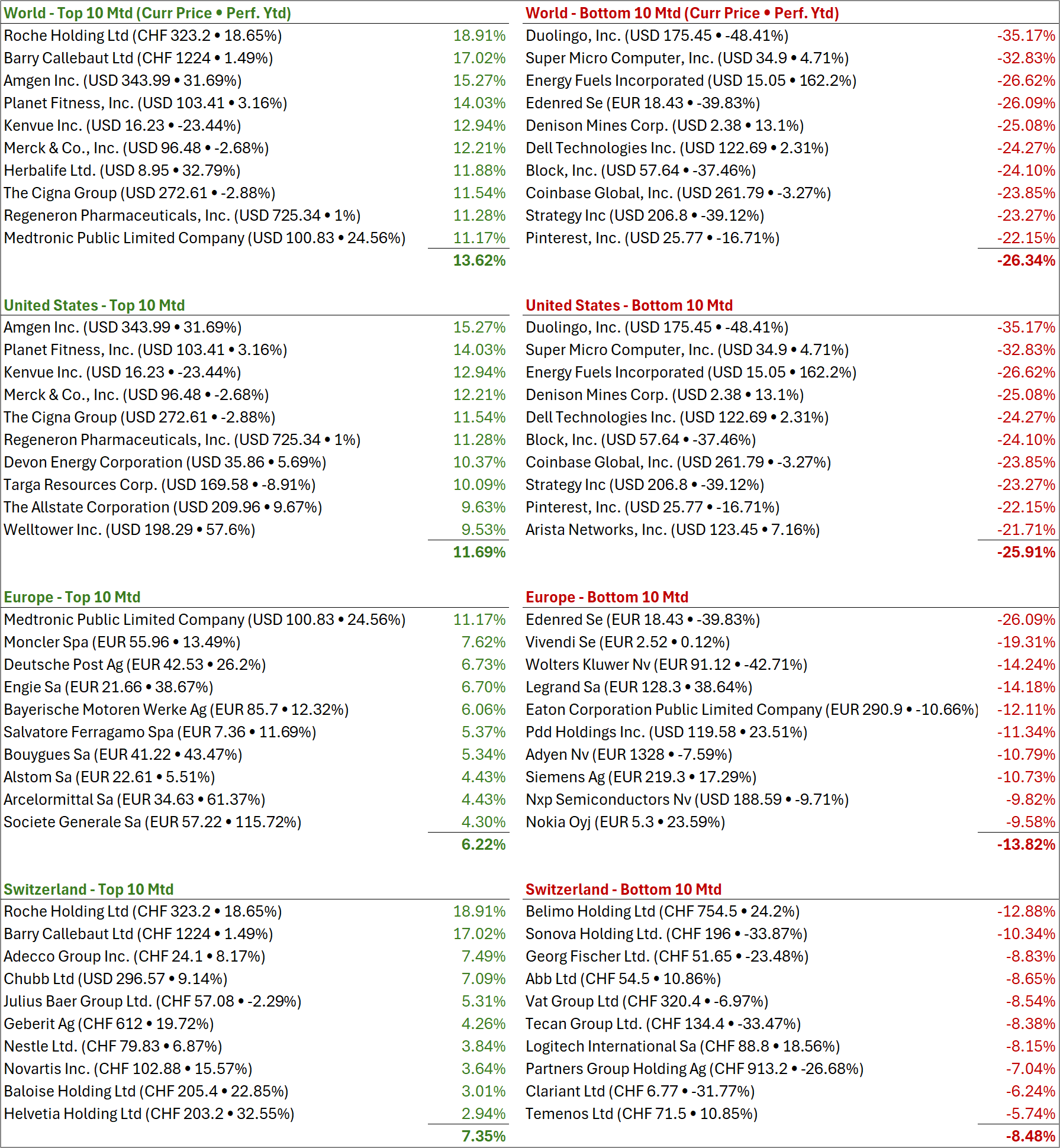

Cryptocurrencies bore the brunt of the risk-off move. Since their October highs, Bitcoin has corrected and this morning trades around Usd 91'000–92'000 (-15.5% MTD and -26% from the high); Ethereum changes hands around Usd 3'050–3'120 (-20% MTD). Sentiment followed prices: the “Fear & Greed Index” fell back into extreme fear around 11–12/100, a low for the recent cycle. On commodities, gold is consolidating below its October peaks and oscillates around Usd 4'070–4'110 per ounce.

November 13–14 marked the bear’s wake-up: the KOSPI sold off with local tech leaders before a technical rebound fueled by foreign buying; volatility is back as the norm.

Waiting for Nvidia’s results

Markets are nervously awaiting Nvidia’s results for the third quarter of fiscal year 2026, released after the close tonight (19.11). Futures are ticking up a bit ahead of it, but everyone is watching the message on the Blackwell chip and the durability of margins; given Nvidia’s weight in the S&P500 and Nasdaq-100, an upside or downside surprise can move the whole edifice.

Switzerland: Roche lifts the SMI

Against the grain, Switzerland had its “Roche moment.” The stock jumped after positive results from a late-stage study for Giredestrant, an oral SERD for breast cancer, showing a significant improvement in invasive disease-free survival. It’s exactly the kind of clinical readout that changes how a pipeline is perceived: fewer doubts, more visibility; and, by ricochet, a defensive SMI that breathes when risk appetite stalls.

Few numbers

For Thanksgiving, America will waste about 145'150 tonnes of food—roughly Usd 550m thrown away in a single day (source: ReFED).

Record broken: by end-September, Île-de-France had 6.126 million m² of vacant offices, according to Immostat; +17% year-on-year.

By end-2024, for the first time since 2000, private equity will underperform the S&P500 over 1, 3, 5, and 10 years, according to the State Street Private Equity Index.

Editorial

Overeducated and underpaid

With Jonathan (founding partner at B-R & H Finance), between us we have five children aged 11 to 21. I keep wondering how AI will shape their working lives. The news from the United States isn’t comforting: 153,074 job cuts last month. Year to date: 14,000 at Amazon, 15,000 at Microsoft, and 21,000 at Intel. For U.S. managers, more spending on AI translates into fewer hires. AI has become the official pretext to announce workforce reductions or freezes on junior roles.

Switzerland’s financial sector pays interns very well (around CHF 4k), but that rate has barely moved in 15 years. Little to no adjustment while the cost of living keeps rising. It signals a deeper shift: finance has normalized. It’s no longer a pressure-cooker sector.

I used to ask: “Does finance have a future?” “Can you still live very well as an employee?” With AI, the questions cut across everything. Many will fall behind; pressure will build for a universal income; in some countries, irrationality and obscurantism will regain ground; birth rates will slip; and yet, ultimately, life will be gentler: better health, unpleasant tasks automated.

I don’t want our children to be a sacrificed generation. They need to be ahead of their time. I don’t want them to fall into the overeducated and underpaid trap.

Today, the young graduate is a threat

Young people are often naïve about work; they don’t factor in that their seniors want to keep their seats. That isn’t cynical; it’s human. Companies used to be pyramids: as one climbed, more people below contributed to your P&L. It was a real-world version of a Ponzy scheme. Each level came with its quota of subordinates. The question was how many direct reports one could manage effectively.

Now, with AI, even an intern can command an army of AI agents working for them (often without their supervisor noticing). They can do more, better, faster. Just as our parents struggle with the internet, IoT, Bluetooth, the upper layers of firms with 10–20 years of experience lack the time and skills to stay at the cutting edge of AI. The intern will end up standing out—and their line manager may be shown the door.

AI is not a rival

It’s a tireless employee that needs clear briefs (prompting). AI doesn’t claim authorship. It has no ego and no career to protect. It widens gaps: the quick get quicker; the slow drop out sooner.

Simple conclusion: well-equipped juniors gain an edge over middle management. Organizations will flatten. Early adopters will render large segments of the “middle layer” obsolete.

So, if you want to steer your children

Make sure they’re at the frontier as AI users. Pay for courses (even if teachers aren’t always the spearhead). Have them master agent-based workflows and keep their digital “armies” in perfect working order.

And for investors?

In France, labor costs represent roughly 65–67% of a company’s expenses. With output unchanged, any headcount reduction mechanically lifts margins; profits follow. Also, a junior costs less than a manager, which again boosts output per euro—so profits rise. QED.

Receive market insights (and more) on the first and third Friday of each month.

If you enjoy this newsletter, please share it

Wealth

Toward the end of the transhumance

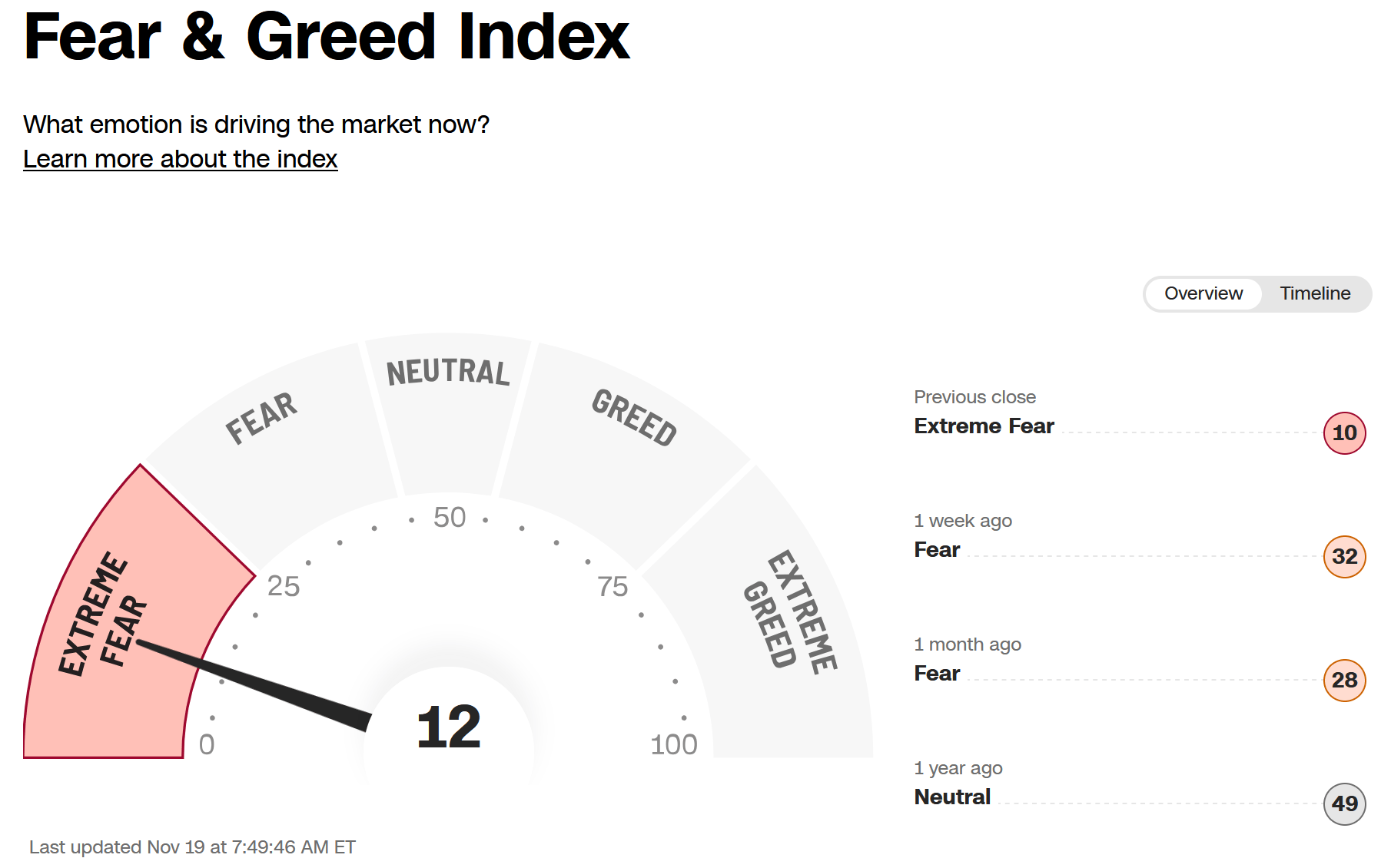

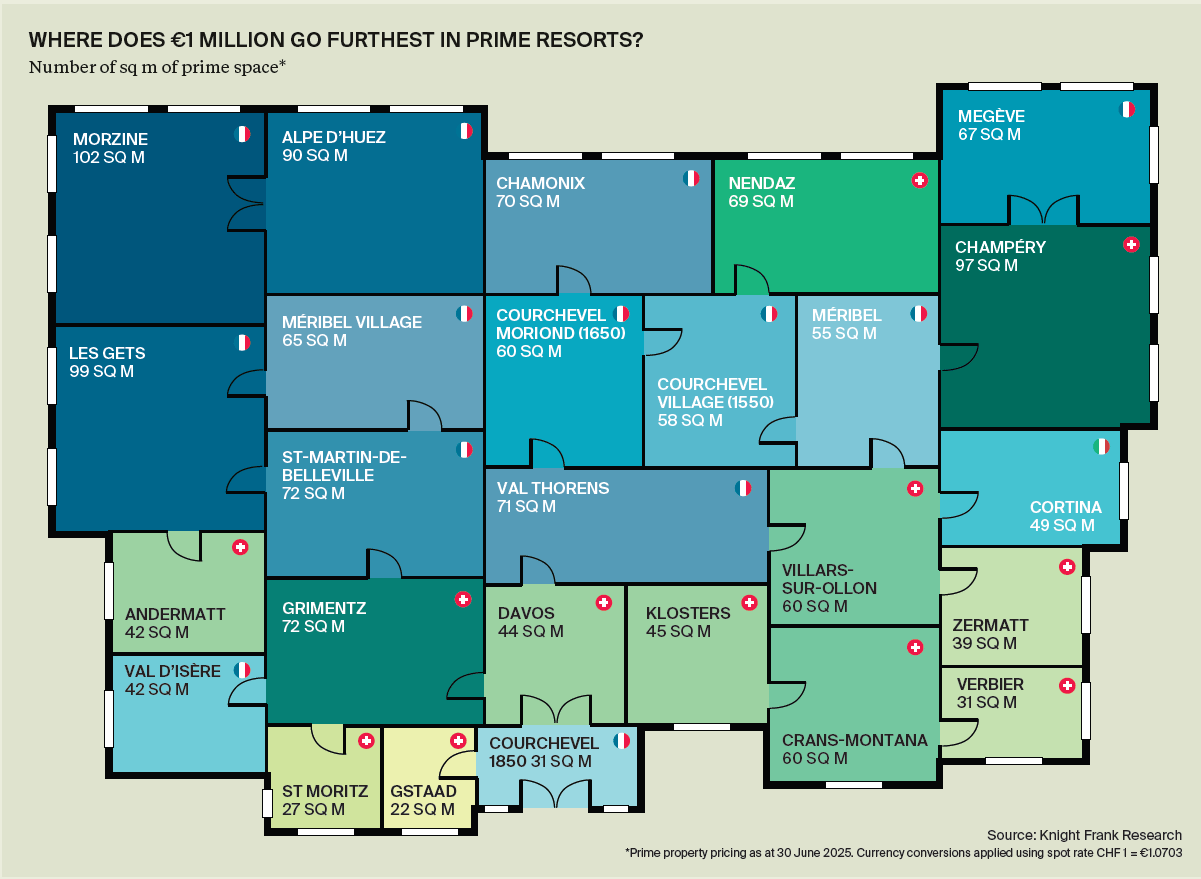

Alpine resorts are no longer just playgrounds for three months of skiing; they’re year-round places to live. Over five years, prices have climbed about 23%, and the Knight Frank index is still up 3.3% year-on-year, with Swiss resorts leading (roughly +5% versus +1.2% in France). As the author sums it up, “the Alpine market has shifted from winter playgrounds to year-round refuges”.

The price ladder is clear. Gstaad sits on top, followed by St. Moritz, then Verbier and Crans-Montana on the Swiss side, while Courchevel, Méribel, and Megève lead in France. With Eur 1 million, you barely buy 22 m² in Gstaad and 27 m² in St. Moritz, versus 31 m² in Verbier or Courchevel 1850, 60 m² in Crans-Montana, 67 m² in Megève, and more than 100 m² in Morzine. In short, prestige comes at a steep price, but some well-known resorts still offer a “livable” footprint for a similar budget.

|

Behind these price moves is a highly motivated buyer base. In the Alpine Sentiment Survey of more than 570 wealthy individuals, 56% say they plan to buy an Alpine property; only 26% are firmly opposed, with the rest undecided. Appetite is strongest in China (88% plan to buy), the UAE (82%), the UK (76%), and the US (53%). Half are aiming below Eur 2 million; the others range from Eur 2 million to more than Eur 20 million. About half want a purely private refuge, 44% plan mixed use between personal stays and rentals, and only a small minority view a chalet as a pure investment product.

The dream is increasingly permanent: 73% say they would be willing to live year-round in the Alps while working remotely, rising to roughly 80% among millennials.

Policy and climate now play a bigger role. In Switzerland, Lex Koller and Lex Weber lock the supply and reinforce scarcity in resorts like Verbier, Crans, or Gstaad. In France, new rules govern second homes and short-term rentals, while energy-inefficient properties will gradually be pushed out of the rental market. Megève, Crans-Montana, Gstaad, and Méribel are betting on “four seasons”: golf, cycling, hiking, wellness. For many investors, the Alps are becoming a kind of European “climate firebreak”.

Finally, the report drops a few arbitrage stories, such as Cortina d’Ampezzo—still far cheaper than St. Moritz even as it readies for the 2026 Olympics and major infrastructure plans, with an ultra-elite offering.

You can be born old, just as you can die young.

B-R & H Finance

Founded in 2004, B-R & H Finance SA is a Swiss entity specialized in wealth management. We offer a full range of personalized and independent investment services and advisory solutions. Regulated by SO-Fit and authorized by FINMA, we are also members of the ASG (Swiss Association of Independent Asset Managers) and work with leading custodian banks.

Affiliate Programs and Sponsored Content: Please note that while we strive to provide accurate and up-to-date information, we are not responsible for the content of external sites referenced in our articles, reports, or any other materials. Some links may direct you to affiliate programs or sponsored content, which will be indicated by an asterisk (*). We do not manage or endorse the privacy practices, content, or policies of these third-party sites. We encourage you to carefully read their privacy policies and terms and conditions before engaging with them.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell securities or adopt an investment strategy. The information, opinions, and analyses presented here are based on sources believed to be reliable and are expressed in good faith, but no explicit or implicit guarantee is made regarding their accuracy, completeness, or reliability. Stock market investments are subject to market and other risks, and there is no guarantee that investment objectives will be achieved. Past performance is not indicative of future results.